What does it mean when you come across a house you adore listed as “contingent”? A contingent house listing means a seller has accepted an offer, and the home is now under contract.

But before the sale can be finalized, some contingencies or conditions must be met. These contingencies are clauses in the sales contract. Common contingencies include a home appraisal, home inspection and mortgage approval contingency.

Prepare for your home buying journey by learning what “contingent” can mean for you and mastering the skill of decoding common house-listing statuses, like “contingent” and “pending.”

What Does Contingent Mean?

Contingent is a status that shows a home is under contract, and completing the sale depends on satisfying specific actions. These actions are commonly called contingencies and can make or break a deal.

Before a house on the market can become a contingent listing, the home seller must accept an offer with contingencies outlined by a buyer. Common contingencies include:

- Appraisal contingency

- Financing contingency (also called a mortgage contingency)

- Home inspection contingency

- Home sale contingency

- Title contingency

Contingencies protect buyers from some risks associated with buying a home. For instance, if a home inspector discovers that a home’s roof requires significant repairs, the buyer can use the home inspection contingency to cancel the deal without losing their earnest money deposit.

Sellers aren’t typically fans of offers attached to a long list of contingencies, especially in a competitive housing market. You should use contingencies sparingly and only when they make sense for you.

If you’re unsure which contingencies to include, talk to a real estate agent or Realtor and discuss your options. They can help you write up your bid and make recommendations to help you craft a competitive offer.

What’s Your Goal?

Buy A Home

Discover mortgage options that fit your unique financial needs.

Refinance

Refinance your mortgage to have more money for what matters.

Tap Into Equity

Use your home’s equity and unlock cash to achieve your goals.

Types Of Contingencies In Real Estate

Let’s take a deeper look at the different types of real estate contingencies you may encounter:

Appraisal Contingency

An appraisal contingency is a common contingency in real estate contracts. The clause allows a home buyer to back out of a deal if the home appraisal returns at a lower value than the agreed purchase price.

If the appraisal comes in lower than the offer, the lender may lower the loan approval amount or deny the loan. Buyers can appeal for a second appraisal if they think the home is worth more than the appraised value. Or they can negotiate a lower sale price with the seller if they still want to purchase the home.

Finance Contingency

Most home buyers use a loan to buy a house – but don’t know whether the loan is approved until a few days before closing. A mortgage contingency is a safety net in case a lender doesn’t approve the mortgage. At that point, the buyer can back out of the deal without incurring major penalties.

A lender can deny mortgage approval for several reasons, including a low home appraisal or a significant change in a buyer’s financial situation since the lender’s initial approval.

Home Inspection Contingency

Home inspection contingencies protect home buyers by requiring that the home pass professional inspection before finalizing the contract. Suppose the home inspection uncovers major renovations or repairs. In that case, the home buyer can walk away from the purchase, ask for a lower price or negotiate with the seller to have them complete the repairs.

Home Sale Contingency

Buying a home while preparing to sell your current home can get complicated. A home sale contingency helps safeguard buyers from the financial burden of paying two mortgages at once. The clause allows a buyer to terminate the sale if their current home doesn’t sell by a specified date. The purchase contract only moves forward if the buyer secures a buyer for their own home and completes the home sale.

Title Contingency

A title search involves researching public records to ensure a property has no unknown liens or additional owners with rights to the property that can affect the purchase. The records are reviewed for old debts, property liens and other possible defects. A primary goal of the search is to ensure the seller has every right to sell the property to avoid ownership disputes down the road.

The buyer can cancel the agreement if the title search reveals unpaid property taxes or ownership questions. Most lenders require a title contingency. Even cash buyers are advised to include this clause in their contracts.

Ready To Become A Homeowner?

Get matched with a lender that can help you find the right mortgage.

Types Of Contingent Statuses In Real Estate

A property can be listed as “contingent” under different status classifications. The Multiple Listing Service, or MLS, is a real estate marketing and advertising database real estate professionals use to browse listings online. Because the MLS uses different terminology when describing contingent status, we’ll provide clear definitions below.

Contingent: Continue To Show (CCS)

A “contingent: continue to show” status means a seller has accepted an offer, and multiple contingencies must be satisfied. While the buyer works on the contingencies, other buyers can still view the property and submit offers.

No-Show

Unlike a CCS status, a no-show status means that once a seller has accepted an offer with contingencies, they’ll no longer show the house or accept offers. Once the buyer addresses all the contingencies, the listing will move to “pending,” and the closing process can begin.

With Kick-Out

A contingent status with a kick-out clause lets a seller continue to market their home if they receive an offer with contingencies, allowing them to “kick out” a buyer with contingencies if they receive a better offer.

With No Kick-Out

A contingent status with a no kick-out clause means an offer is accepted, and the seller can’t accept another buyer’s offer. Even if the seller receives a higher offer, they can’t accept it.

Active Short Sale Contingent

A short sale occurs when a seller’s lender is willing to accept less than the amount the seller owes on a mortgage. An active short sale contingent status lets other agents know the home is no longer for sale because the seller has accepted an offer.

Contingent Probate

Contingent probate is common when dealing with an estate after death. It means a lawyer will receive a portion of the estate as payment for completing the probate process.

Take The First Step To Buying A Home

Find a lender that will work with your unique financial situation.

Can You Make An Offer On A Contingent House?

Depending on a property’s contingent status, buyers may be able to submit offers when a contingent listing is classified as:

- Continue To Show

- With Kick-Out

- Contingent Probate

Even with a signed contract, a seller may be able to accept a second offer if the original buyer fails to fulfill any contingencies, which would void the first contract. For example, some contracts may void a deal if a buyer doesn’t complete all contingencies within 30 days.

Unless a contingency allows it or the buyer backs out of the deal and forfeits their earnest money, a seller typically can’t back out of a contract without risking legal action.

Any seller considering additional offers after a home becomes a contingent listing should consult a real estate attorney before making any new agreements.

Contingent Vs. Pending: What’s The Difference?

A contingent offer means a seller has accepted an offer but hasn’t satisfied the buyer’s requirements to close the deal. Pending status means a seller has accepted an offer, and all contract contingencies have been satisfied, so the purchase is nearing completion.

Pending deals aren’t active listings – it just indicates that the buyer and seller are completing the legal work to finalize the home sale. Contingent homes are active listings sellers may continue to show in most cases. The seller may continue to accept additional offers on the house until all contingencies are satisfied.

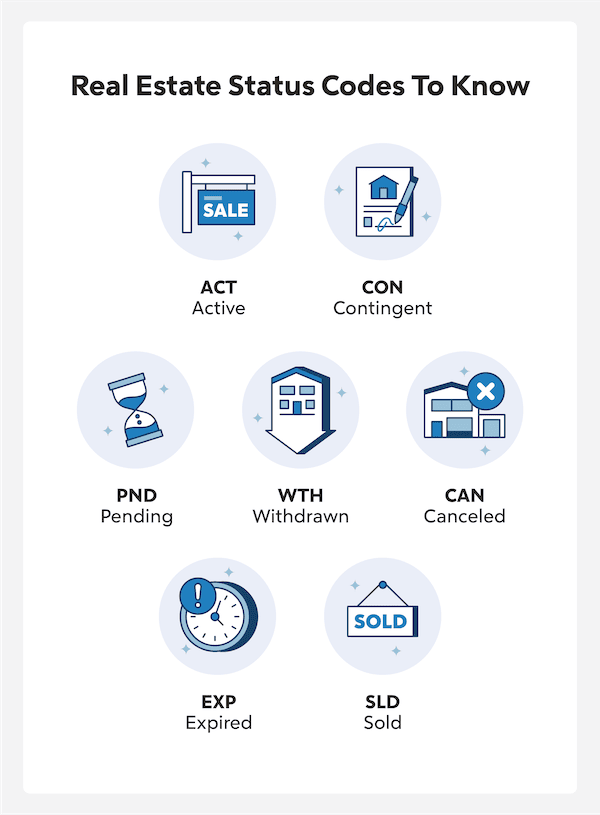

Real Estate Codes To Know

Prospective buyers should also become familiar with the real estate codes that help buyers and real estate professionals understand the availability and status of a property. Some real estate codes include:

FAQ

Still wondering whether it’s worth making an offer on your dream home with a contingent status? Check out these additional questions for more insight:

If you submit an offer on a contingent house, it’s a good idea to keep house hunting while the seller works through pending contingencies.

“Pending” means all contract contingencies have been satisfied, and both parties are working through legal paperwork to close. While this is great for sellers ready to move to their new property, it means a home is effectively unavailable to new prospective buyers.

However, if you’re willing to purchase the property regardless of any issues, a no-contingency offer can help you stand out, especially in a seller’s market.

The Bottom Line

Contingent is a term that applies to a home under contract, but certain conditions outlined in the offer must be satisfied before completing the sale. Motivated house hunters can continue to submit offers despite a property’s listing status. If you find a contingent listing, consult with your real estate agent to determine whether to put an offer in.

Victoria Araj

Victoria Araj is a Staff Writer for Rocket Companies who has held roles in mortgage banking, public relations and more in her 15-plus years of experience. She has a bachelor’s degree in journalism with an emphasis in political science from Michigan State University, and a master’s degree in public administration from the University of Michigan.