If you’re ready to shop for a home, getting mortgage preapproval is a good idea. A preapproval or prequalification letter from a lender states that you should be able to qualify for a mortgage and how much you can expect to borrow.

While it isn’t a guaranteed loan offer, preapproval gives you an idea of how much house you can afford. It also shows real estate agents and sellers that you can secure financing. Some sellers require mortgage preapproval before they’ll accept your offer. You’ll need to provide your lender with some documents to get preapproval. Read on for our checklist.

Key Takeaways:

- Mortgage preapproval gives you an idea of how much you’ll be able to borrow and shows sellers that you’re ready to buy.

- Before lenders can preapprove you for a loan, they will review documents reflecting your financial situation to determine how much you can afford.

- Lenders are most interested in confirming that you have the resources to afford the down payment, closing costs and the monthly payment.

Identification

First and foremost, the lender needs to confirm your identity. Otherwise, someone might try to borrow money in your name and leave you on the line to pay it back. You’ll need a valid, government-issued photo ID. You typically can use a driver’s license, passport, state-issued ID or permanent resident card.

What’s Your Goal?

Buy A Home

Discover mortgage options that fit your unique financial needs.

Refinance

Refinance your mortgage to have more money for what matters.

Tap Into Equity

Use your home’s equity and unlock cash to achieve your goals.

Pay Stubs

Your lender will want proof that you are employed and have a stable income to afford your mortgage payments. You can expect to be asked for copies of recent pay stubs. You should be able to get copies from your employer if you don’t already have them.

Income Tax Documents

Another way lenders verify your income is with your recent tax documents. You’ll likely be asked to provide copies of your income tax returns from the last two years. If you’re employed full time, you may need to include W-2 forms for the previous two years. If you’re a general contractor or freelancer, you can provide your 1099 forms.

Ready To Become A Homeowner?

Get matched with a lender that can help you find the right mortgage.

Profit And Loss Statement

If you’re self-employed, you’ll also need to submit your year-to-date profit and loss statement. This document shows how much revenue your business generates relative to your expenses. Once you subtract total costs from your overall revenue, you’ll have your net profit. This figure also is referred to as your bottom line.

Lease Agreements For Rental Income

If you already own investment properties that you rent out, you’ll need to show those lease agreements. For example, if you have tenants in a long-term lease, that shows the lender that you can rely on that income for a set period.

Take The First Step To Buying A Home

Find a lender that will work with your unique financial situation.

Bank Statements

Your bank statements show your income and how much money you have in the bank. This proves to the lender that you can afford a down payment and keep up with your monthly mortgage payments. Your bank statements also will reveal any red flags, like overdrafts or unstable income. The lender typically asks for statements from both your checking and savings accounts for the last one or two months.

Retirement Account Statements

The money you’ve saved in retirement accounts will be considered as an asset. This can include 401(k)s, IRAs, Roth IRAs, 403(b) plans and any other retirement investment.

Investment Account Statements

Your lender also will want to know about any other investments you have. This can include stocks, bonds, mutual funds or other investment vehicles.

Credit Card Statements

One of the ways lenders measure your ability to afford a mortgage is by looking at your debt-to-income ratio. Your DTI ratio measures how much of your monthly income is taken up by debt payments. Lenders may ask for your credit card statements to find out how much high-interest debt you have. Having a decent income but a lot of credit card debt can affect how much house you can afford.

Car Loan Statements

Car loans are another type of debt that lenders will want to know about. If your car is completely paid off, that gives you more room in the budget for your mortgage. If you have a sizable car bill each month, that can affect how much a lender may be willing to loan you.

Student Loan Statements

Many people are still paying off student loan debt when they’re ready to buy a home. This is another type of debt that can affect your DTI ratio and how much you can borrow. If you have student loan debt, be prepared to provide those statements to your lender.

Personal Loan Statements

A personal loan is not secured, which means there’s no collateral. As a result, they often come with higher interest rates. Personal loans can be an expensive way to borrow money, and they contribute to your DTI ratio. Lenders will want to know if you have any outstanding personal loans.

Gift Letter

If someone has given you money to help you make a down payment, you’ll need to document it for your lender with a gift letter. This letter confirms that the gift money was not a personal loan and does not have to be repaid. If it were a loan, it would affect your DTI ratio and your ability to qualify for a mortgage. Different lenders and loan options will have different rules about who is able to give you money toward a down payment.

A gift letter typically includes:

- The donor’s name and contact information

- The recipient’s name and contact information

- The relationship between the donor and recipient

- The gift amount

- The date the gift was received

- Confirmation that the money does not need to be repaid

- How the gift money will be used

- Signatures from both the donor and recipient

Current Mortgage Documents

If you already own a home, you’ll need to provide the mortgage paperwork and appraisal report. Your lender will want to know the value of that home and the amount you still owe on the mortgage.

Current Property Tax Statement

Another document you’ll need if you already own a home is your property tax statement. This tells the lender how much you’re obligated to pay each year to local and state governments.

VA Certificate Of Eligibility

If you’re applying for a Veteran Affairs loan, you’ll need a VA certificate of eligibility. VA loans are available only to military service members, veterans and their eligible surviving spouses. A VA certificate of eligibility confirms for the lender that you met the requirements set by the VA and are eligible for a VA loan. You can access your certificate of eligibility using this VA portal.

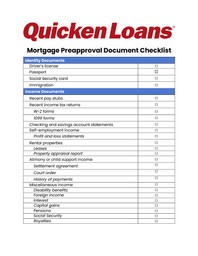

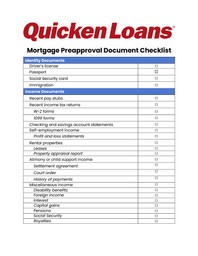

Mortgage Preapproval Documents Checklist

For your convenience, we’ve crafted a checklist of documents needed to get preapproval that you can download as a guide to gathering the paperwork you likely will need.

Click here to download your own copy of the checklist.

FAQ

Here are answers to some common questions about mortgage preapproval:

The Bottom Line

To determine how much they’re willing to preapprove you for a mortgage, a lender must assess your finances to see how much house you can afford. To do this, lenders will review your income, assets, debt and credit, and request various financial documents. Preparing these documents in advance can help expedite the process and keep your home buying journey running smoothly.

More From Quicken Loans:

Rory Arnold

Rory Arnold is a Los Angeles-based writer who has contributed to a variety of publications, including Quicken Loans, LowerMyBills, Ranker, Earth.com and JerseyDigs. He has also been quoted in The Atlantic. Rory received his Bachelor of Science in Media, Culture and Communication from New York University. He also completed the SoFi/Coursera Fundamentals of Personal Finance Specialization consisting of five courses: Introduction to Personal Finance, Saving Money for the Future, Managing Debt, Fundamentals of Investing, and Risk Management in Personal Finance.