As the economy shifts and remote work opportunities arise, more Americans begin searching for new homes. As you begin your home buying journey, it’s important to know the hottest real estate markets and the pros and cons of each.

Using data from Rocket Homes, the U.S. Census Bureau and FRED, we analyzed and ranked the top 18 hottest real estate markets in 2022. Using our guide, you’ll find out which cities are growing at the fastest rate and their average housing prices.

Ready for a change?

Find top-rated movers and compare multiple quotes on HomeAdvisor.

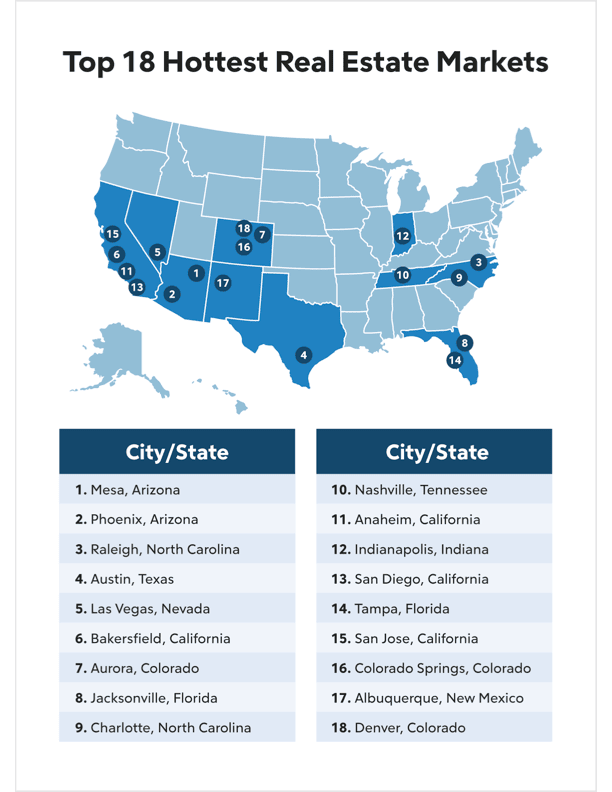

The 18 Hottest Housing Markets In The US

When we measured the increase in median home prices, population and the House Price Index for the 50 most populous metropolitan areas in the U.S., we found that Americans were gravitating toward cities in the Sun Belt with comfortable weather year-round.

City/State | Median Selling Price | Median Selling Price YoY Increase | State House Price Index Increase (Q4 2020 – Q4 2021) | Population Growth (2010 – 2020) |

|---|---|---|---|---|

Mesa, Arizona | $424,977 | 26.40% | 27.99% | 14.85% |

Phoenix, Arizona | $409,925 | 26% | 27.99% | 11.24% |

Raleigh, North Carolina | $371,682 | 25.20% | 20.70% | 15.79% |

Austin, Texas | $571,481 | 24.50% | 19.95% | 21.69% |

Las Vegas, Nevada | $384,748 | 23.30% | 23.81% | 9.96% |

Bakersfield, California | $365,000 | 22.10% | 19.08% | 16.11% |

Aurora, Colorado | $440,751 | 20.40% | 19.71% | 18.82% |

Jacksonville, Florida | $270,023 | 20% | 24.47% | 15.55% |

Charlotte, North Carolina | $354,884 | 18.90% | 20.70% | 19.57% |

Nashville, Tennessee | $460,232 | 18.20% | 22.47% | 14.67% |

Anaheim, California | $787,897 | 18.40% | 19.08% | 3.14% |

Indianapolis, Indiana | $219,997 | 18.10% | 16.92% | 8.19% |

San Diego, California | $800,683 | 17.10% | 19.08% | 6.08% |

Tampa, Florida | $364,808 | 16.20% | 24.47% | 14.67% |

San Jose, California | $1.28 million | 16.70% | 19.08% | 7.11% |

Colorado Springs, Colorado | $458,312 | 16.10% | 19.71% | 15.02% |

Albuquerque, New Mexico | $284,989 | 16.70% | 17.21% | 3.43% |

Denver, Colorado | $575,954 | 15.70% | 19.71% | 19.22% |

We go more in depth on the hottest real estate markets in the U.S. below.

See What You Qualify For

Buy A Home

Discover mortgage options that fit your unique financial needs.

Refinance

Refinance your mortgage to have more money for what matters.

Tap Into Equity

Use your home’s equity and unlock cash to achieve your goals.

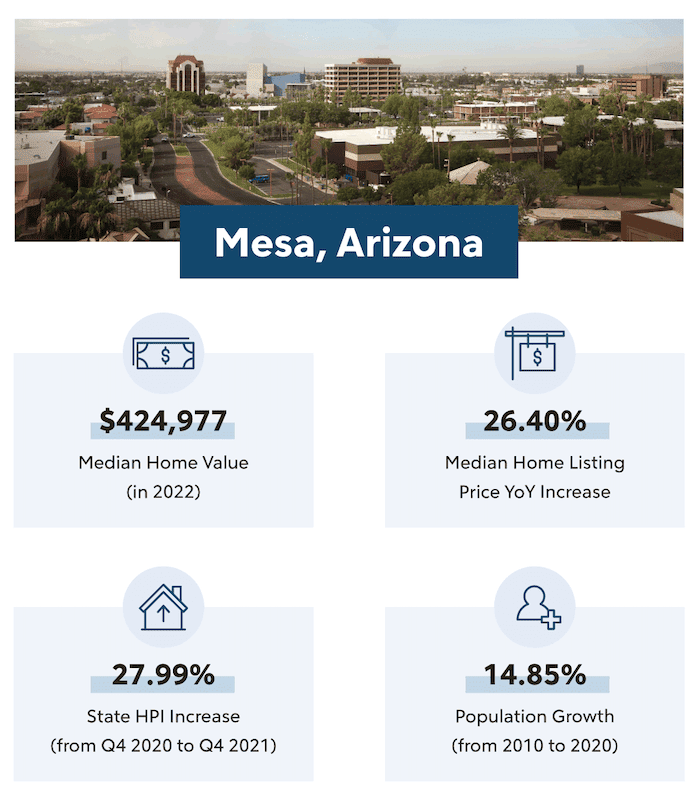

1. Mesa, Arizona

- Median Home Value: $424,977

- Median Home Listing Price YoY Increase: 26.40%

- State HPI Increase (from Q4 2020 to Q4 2021): 27.99%

- Population Growth (from 2010 to 2020): 14.85%

Mesa’s population growth can be attributed to its sunny weather and booming economy. It has parks, lakes and forests, making it a great home for outdoor enthusiasts. Since it’s within driving distance of Phoenix, residents can strike a balance between small town and big city lifestyles.

In April 2022, 60.1% of Mesa’s homes were sold above asking price, showing that its housing market is on the rise2. From April 2021 to April 2022, Mesa’s median housing prices rose by over $88,000.

With its increasing population and appreciating home prices, Mesa is on track to becoming a major city.

See What You Qualify For

You can get a real, customizable mortgage solution based on your unique financial situation.

2. Phoenix, Arizona

- Median Home Value: $409,925

- Median Home Listing Price YoY Increase: 26.00%

- State HPI Increase (from Q4 2020 to Q4 2021): 27.99%

- Population Growth (from 2010 to 2020): 11.24%

While Phoenix is regarded as a great place to retire, its growing population and strong economy makes it equally attractive to younger professionals. Since Phoenix is close to tourist destinations like the Grand Canyon, Las Vegas and Sedona, there’s never a shortage of opportunities for day trips.

The median price of Phoenix homes increased by more than $84,000 from April 2021 to April 2022. Out of the homes sold in April 2022, 62% were sold above asking price2.

This means that if you’re shopping for a home in Phoenix, you should target homes slightly below your budget so you can increase your bid if necessary.

3. Raleigh, North Carolina

- Median Home Value: $371,682

- Median Home Listing Price YoY Increase: 25.20%

- State HPI Increase (from Q4 2020 to Q4 2021): 20.70%

- Population Growth (from 2010 to 2020): 15.79%

Raleigh is a growing hub for younger professionals. Its unemployment rate is lower than the national average at 2.9%, and there are plenty of job opportunities in the mining, logging, transportation and construction industries.

Raleigh’s median housing prices increased by over $74,000 from April 2021 to April 20222. This steep increase suggests that it’s a great opportunity for Raleigh residents to sell.

4. Austin, Texas

- Median Home Value: $571,481

- Median Home Listing Price YoY Increase: 24.50%

- State HPI Increase (from Q4 2020 to Q4 2021): 19.95%

- Population Growth (from 2010 to 2020): 21.69%

Austin is a sunny, fast-growing city with a lively music and cultural scene. The city’s nightlife is a major draw, along with its status as a budding tech hub, now home to companies such as Google and Tesla.

While the number of Austin homes sold decreased by 2% from April 2021 to April 2022, its median home selling price increased by 24% from April 2021 to April 20222.

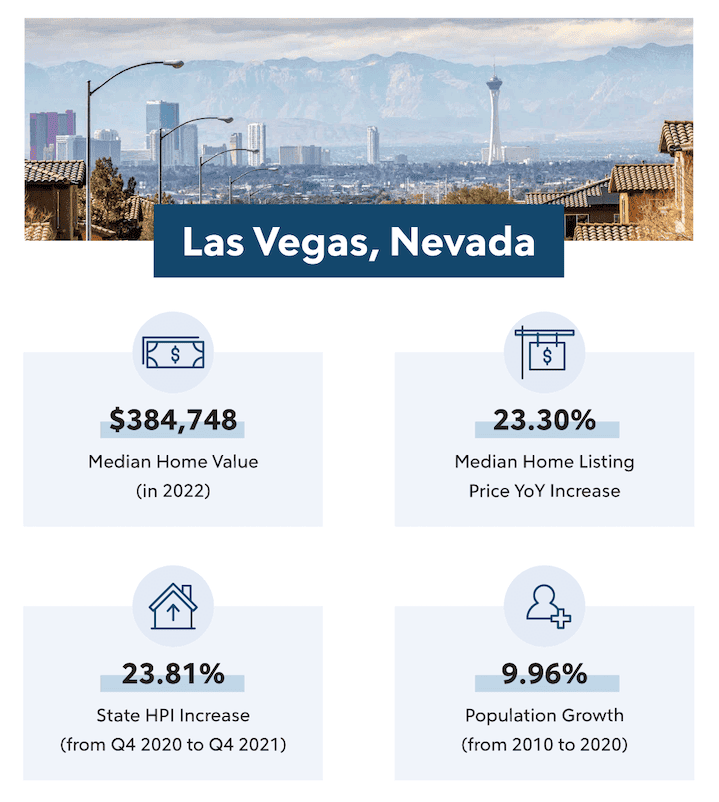

5. Las Vegas, Nevada

- Median Home Value: $384,748

- Median Home Listing Price YoY Increase: 23.30%

- State HPI Increase (from Q4 2020 to Q4 2021): 23.81%

- Population Growth (from 2010 to 2020): 9.96%

While Las Vegas is known for its bustling nightlife and casinos, residents can also engage in outdoor activities at Valley of Fire State Park and Red Rock Canyon. Vegas is known for its master planned communities with lakes, bike paths, trails and golf courses. It’s no wonder the average sale time of a home has gone down by 36% from April 2021 to April 2022.

From April 2021 to April 2022, Las Vegas has been a real estate seller’s market with about 60% of homes being sold above asking price2.

6. Bakersfield, California

- Median Home Value: $365,000

- Median Home Listing Price YoY Increase: 22.10%

- State HPI Increase (from Q4 2020 to Q4 2021): 19.08%

- Population Growth (from 2010 to 2020): 16.11%

Compared to other hot real estate markets, Bakersfield has a lower housing cost and an abundance of job opportunities. Since Bakersfield is right next door to Los Angeles, a big city lifestyle is a short drive away.

The median price of Bakersfield homes increased by $66,000 from April 2021 to April 20222. The total number of homes for sale decreased by 10.6% from March 2022 to April 2022.

As sale prices go up and sale times go down, home buyers need to be ready to act fast when purchasing a home.

7. Aurora, Colorado

- Median Home Value: $440,751

- Median Home Listing Price YoY Increase: 20.40%

- State HPI Increase (from Q4 2020 to Q4 2021): 19.71%

- Population Growth (from 2010 to 2020): 18.82%

Aurora is the third largest city in Colorado and home to a diverse population. Aurora offers a growing number of jobs in the healthcare, social assistance, food services and retail industries. Its high cost of living is balanced by its median household income of $69,720.

The total number of homes for sale in Aurora increased by almost 20% from April 2021 to April 20222. Since home prices are going up, this suggests that Aurora is increasing its home inventory to meet demand.

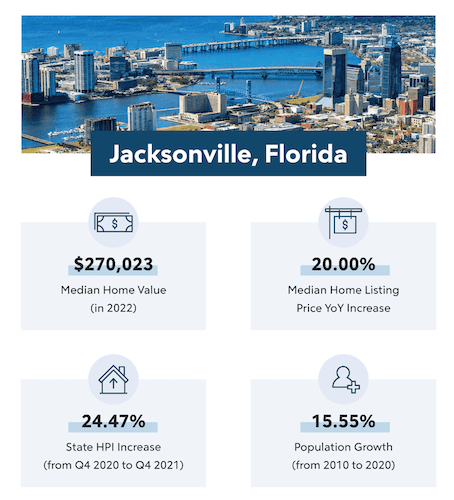

8. Jacksonville, Florida

- Median Home Value: $270,023

- Median Home Listing Price YoY Increase: 20.00%

- State HPI Increase (from Q4 2020 to Q4 2021): 24.47%

- Population Growth (from 2010 to 2020): 15.55%

Jacksonville offers wide beaches, a thriving nightlife and the nation’s largest urban park system. But despite its luxurious attractions, the city has a relatively affordable cost of living.

While Jacksonville home prices have increased by about $45,000 since April 2021, the median selling price remains at about $270,000, making it one of the more affordable real estate markets on our list2.

9. Charlotte, North Carolina

- Median Home Value: $354,884

- Median Home Listing Price YoY Increase: 18.90%

- State HPI Increase (from Q4 2020 to Q4 2021): 20.70%

- Population Growth (from 2010 to 2020): 19.57%

While Charlotte’s seasons are distinct, its weather is generally pleasant throughout the year. This, combined with features such as a strong education system and fantastic museums, make it optimal for raising a family.

Charlotte is a real estate seller’s market, as indicated by 72% of its homes being sold above asking price in April 20222.

As homes continue to trend higher in price, it’s important for buyers to get mortgage preapproval to stay competitive in a house hunt.

10. Nashville, Tennessee

- Median Home Value: $460,232

- Median Home Listing Price YoY Increase: 18.20%

- State HPI Increase (from Q4 2020 to Q4 2021): 22.47%

- Population Growth (from 2010 to 2020): 14.67%

Nashville promises new homeowners lower taxes and an exciting nightlife. Residents also have their choice of eateries and live music venues. Nashville’s central location in Tennessee means residents are within driving distance of the Kentucky Bourbon Trail and The Great Smoky Mountains.

The homes for sale in Nashville decreased by almost 8% from April 2021 to April 2022, with over 90% of homes being sold in under a month2.

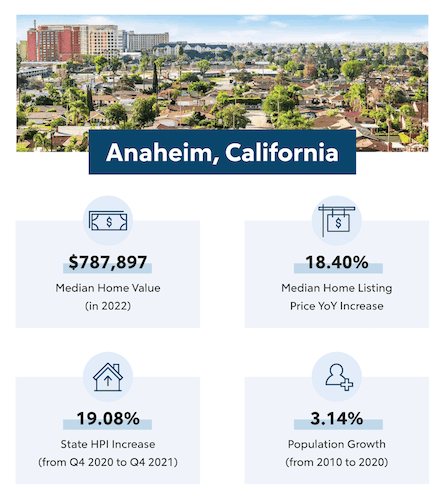

11. Anaheim, California

- Median Home Value: $787,897

- Median Home Listing Price YoY Increase: 18.40%

- State HPI Increase (from Q4 2020 to Q4 2021): 19.08%

- Population Growth (from 2010 to 2020): 3.14%

Anaheim is home to Disneyland as well as sports teams like the Los Angeles Angels and Anaheim Ducks. Plus, it’s only a 30-minute drive from the beach! Anaheim has sunny weather year-round, with a strong economy bolstered by Disneyland and University of California, Irvine as some of its largest employers.

Homes in Anaheim increased in price by over $122,000 from April 2021 to April 20222. In the same time period, the average sale time for a home decreased from 13 days to nine days.

As sale times decrease, it’s important to find a real estate agent to help you snag a home before it’s too late.

12. Indianapolis, Indiana

- Median Home Value: $219,997

- Median Home Listing Price YoY Increase: 18.10%

- State HPI Increase (from Q4 2020 to Q4 2021): 16.92%

- Population Growth (from 2010 to 2020): 8.19%

Indianapolis features a large sports scene and a growing economy with strong healthcare, tourism and sports industries. The city has over 800,000 residents, making it the economic center of Indiana3.

While about 53% of homes are sold above asking price, Indianapolis has a low median home price of $219,9972.

Cheaper homes in metropolitan areas like Indianapolis offer a great opportunity for residents from more expensive markets who are trying to buy and sell a home at the same time.

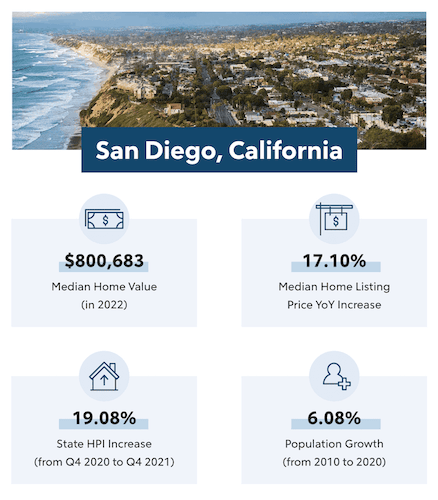

13. San Diego, California

- Median Home Value: $800,683

- Median Home Listing Price YoY Increase: 17.10%

- State HPI Increase (from Q4 2020 to Q4 2021): 19.08%

- Population Growth (from 2010 to 2020): 6.08%

San Diego’s weather hovers around 70 degrees throughout the year. Positioned right next to the beach, this city is a great place to surf, fish or snorkel. Since the median age in San Diego is 34.93, it’s an attractive location for millennials. While the cost of living is high, its flourishing job market and natural landscape make it an attractive place to live.

The median price for San Diego homes increased by over $116,000 from April 2021 to April 20222. From March to April 2022, the number of homes sold in San Diego increased by 18%, indicating that it’s becoming more competitive to become a resident.

14. Tampa, Florida

- Median Home Value: $364,808

- Median Home Listing Price YoY Increase: 16.20%

- State HPI Increase (from Q4 2020 to Q4 2021): 24.47%

- Population Growth (from 2010 to 2020): 14.67%

The Tampa Bay area includes several gems along Florida’s Gulf Coast, namely St. Petersburg and Clearwater. Because of factors like the area’s sunshine, Tampa is one of the best places to retire. It also appeals to younger prospective owners looking for warm weather year-round.

The average sale time for a home in Tampa halved from April 2021 to April 2022, despite the fact that Tampa’s median housing price increased by over $50,000 in the same time period.

This could suggest that the real estate market is going to continue its trend further toward a seller’s market.

15. San Jose, California

- Median Home Value: $1.28 million

- Median Home Listing Price YoY Increase: 16.70%

- State HPI Increase (from Q4 2020 to Q4 2021): 19.08%

- Population Growth (from 2010 to 2020): 7.11%

San Jose is the capital of Silicon Valley, featuring comfortable weather year-round and safe suburban neighborhoods. Because San Jose is home to a booming tech industry and attractions like the Winchester Mystery House, the cost of living is high.

While the number of homes for sale in San Jose increased by about 9% from March to April 2022, 90% of the homes sold in the same time frame were sold above asking price2. Homes are sold on average within eight days as of April 2022.

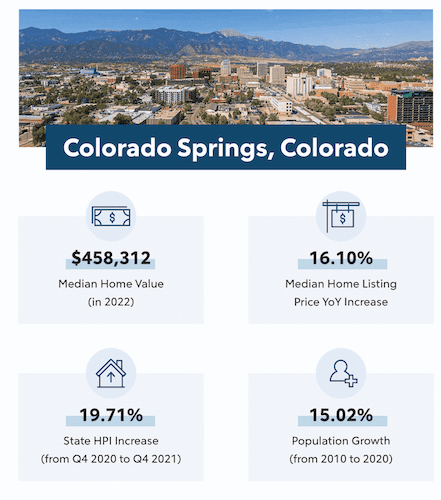

16. Colorado Springs, Colorado

- Median Home Value: $458,312

- Median Home Listing Price YoY Increase: 16.10%

- State HPI Increase (from Q4 2020 to Q4 2021): 19.71%

- Population Growth (from 2010 to 2020): 15.02%

Colorado Springs is a city with a suburban feel that features farmers markets, art festivals and concerts. Whether you want to visit the Garden of the Gods or hike Pikes Peak, residents have access to plenty of outdoor activities. While Colorado Springs has a lower cost of living than bigger cities, Denver is only an hour away.

59% of homes sold in Colorado Springs from April 2021 to April 2022 were sold in 30 to 90 days2. Compared to real estate markets like Anaheim and Albuquerque, Colorado Springs homes take much longer to sell. This suggests that buyers could have less competition in this market.

17. Albuquerque, New Mexico

- Median Home Value: $284,989

- Median Home Listing Price YoY Increase: 16.70%

- State HPI Increase (from Q4 2020 to Q4 2021): 17.21%

- Population Growth (from 2010 to 2020): 3.43%

Albuquerque has a low cost of living and growing industries in tech and film. Films like “The Avengers” and shows such as “Breaking Bad” were shot in this city, taking advantage of its beautiful scenery. Since an abundance of parks cover the city, there’s never a shortage of outdoor activities in Albuquerque.

Almost 20% of Albuquerque homes sold from April 2021 to April 2022 were sold under their asking price2. Homes were sold in an average of eight days in April 2022. These stats suggest that it’s less competitive to acquire a home in Albuquerque than some of the other cities on our list.

18. Denver, Colorado

- Median Home Value: $575,954

- Median Home Listing Price YoY Increase: 15.70%

- State Home PI Increase (from Q4 2020 to Q4 2021): 19.71%

- Population Growth (from 2010 to 2020): 19.22%

While Denver isn’t yet considered a major city like Los Angeles or San Francisco, it’s rapidly growing. Both Denver’s population and its median home value are on the rise.

With growing tech, agriculture and aerospace industries, Denver is a great place to start or continue a lucrative career. While acclimating to the city’s weather can be tricky, its entertainment options like Red Rocks Amphitheatre and the Denver Museum of Nature and Science make the city a desirable place to be.

While Denver’s number of homes for sale has gone up by 14% from April 2021 to April 2022, 79% of homes sold during that same time period were sold above asking price2.

Home Buying In Hot Real Estate Markets In 2022

If you’re interested in buying or selling a home this upcoming year, you’ll face some stiff competition due to the ongoing seller’s market.

A seller’s real estate market means that there is a shortage of available homes for sale. As a result, sellers have their selection of offers from buyers, including offers above the asking price.

Because of the current market conditions, it’s important to know where you stand. Before selling or buying a house, discuss your options with your real estate agent. If you’re a buyer, they can help you determine the best strategy to purchase a home.

If you’re a seller, you should talk about what you want out of your sale. For example, maybe you want a rent-back agreement that allows you to stay in the home after closing for a set time period.

The Bottom Line

The real estate market has been a rollercoaster since 2020. From the suburbs to major metros, many areas will continue to grow during the upcoming year. However, the drastic selling prices should settle down with time.

Take the first step toward buying a house.

Get approved to see what you qualify for.

Matt Cardwell

Matt Cardwell is a Staff Writer for Rocket Companies. During his nearly 15 years with Rocket Mortgage, Matt has occupied a diverse array of marketing leadership roles, including leading and growing the company’s early digital and internet marketing efforts; Editor-in-Chief of the Rocket Publishing House; Vice President of Marketing; Director of Social Media; and Director of Business Channel Strategy. Matt was also an operating partner at Rockbridge Growth Equity, a Detroit-based private equity firm.