Homeowners sometimes find out the hard way that while water is life-giving, it also has a destructive side that can turn our homes into aquatic disasters. Imagine waking up to burst pipes, leaky appliances or a sudden downpour that transforms your sanctuary into a waterlogged mess. Fortunately, homeowners insurance can offer financial protection against specific types of water damage, including broken pipes, hidden leaks, roof leaks and ice dams. However, understanding your policy’s limitations is crucial because traditional policies don’t cover some catastrophes, such as floods and mudslides. When asking your provider, “does homeowners insurance cover water damage?,” make sure they specify the type of damage covered and how you should handle water-related emergencies.

Does Your Home Insurance Cover Water Damage?

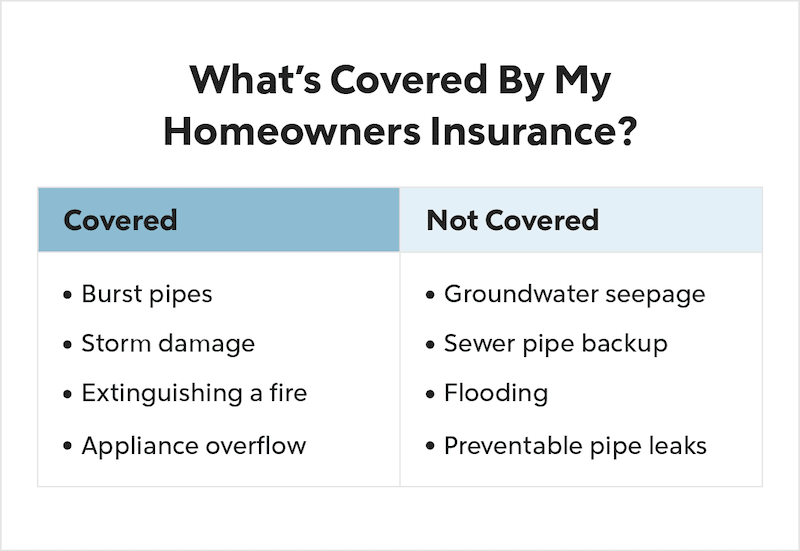

Many homeowners insurance policies cover water damage from an internal source or an accident. If the water damage comes from an external source, such as a flood, or could have been prevented with proper maintenance, it may not qualify for coverage.

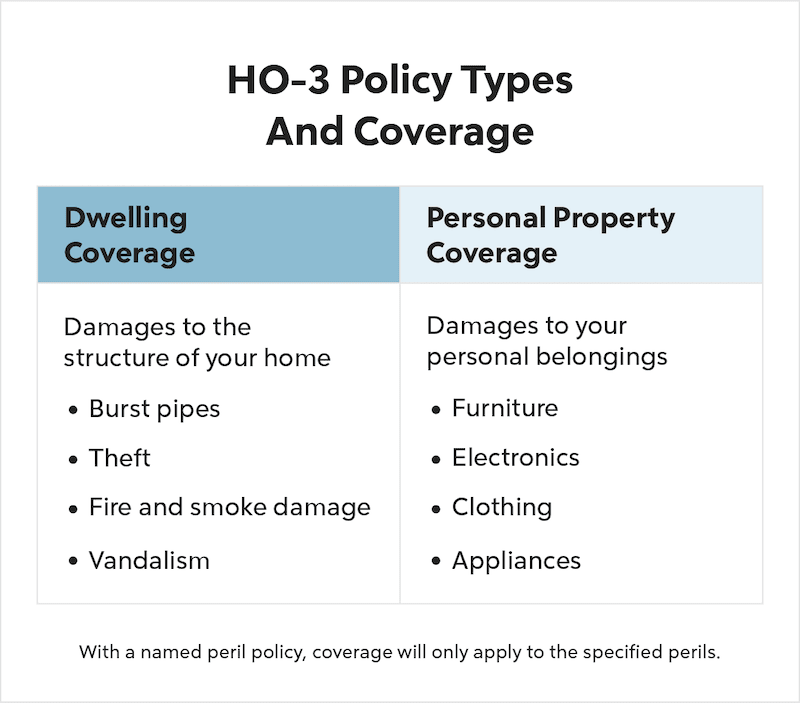

For example, a conventional homeowners insurance policy (called an HO-3 policy) covers specific types of water damage, such as leaking appliances and burst pipes. Remember, homeowners can purchase cheaper policies with the drawback of less coverage. Specifically, HO-1 policies are the least expensive and don’t cover water damage, while HO-2 policies cover damage from snow, ice and internal water or steam accidents.

Types Of Water Damage Covered By Homeowners Insurance

Homeowners insurance covers water damage if the damage is accidental and sudden. Standard HO-3 policies typically offer two types of coverage: dwelling and personal property. As a result, your policy can cover damage water inflicts on your home and your possessions, such as a computer or couch.

Broken Pipes

Damage caused by leaking pipes due to improper installation of your plumbing system or appliances is usually covered. You’ll be covered by your homeowners insurance policy if you have frozen pipes that burst in a heated home. Homeowners insurance will typically cover the cost of interior repairs, like floors and walls, and the cost of damaged belongings.

Remember that your home insurance won’t cover the damaged pipes or the source of the water damage. You’ll need to hire a professional plumber to repair the damaged appliance and use personal funds to cover it.

This coverage is crucial: according to the Insurance Information Institute, 23.5% of homeowners insurance claims in 2021 were for water damage and freezing.

Hidden Leaks

Hidden leaks refer to water damage caused by plumbing issues that are not immediately visible or noticeable. This type of damage can be devastating because of how quickly it can occur without a homeowner noticing. Homeowners insurance usually covers sudden and accidental water damage resulting from hidden leaks. For example, if a pipe bursts inside a wall and causes water damage to your property, your insurance policy would typically cover the cost of repairing the damage. However, coverage usually only extends to repairing the plumbing system itself if a covered peril damages it.

Fire Fighting Efforts

In addition, your homeowners insurance will pay for water damage caused by extinguishing a fire. So, if firefighters use water to put out a fire in your house, a typical policy will cover damages from the water. Likewise, it covers damage from a sprinkler system.

However, negligence can prevent your insurance policy from kicking in. For example, if an old stovetop in need of repair caused the fire, your insurance company may deny your claim.

Roofing Issues

Roof leaks can occur for various reasons, such as storms, aging or poor maintenance. Whether your homeowners insurance covers roof leaks and resulting water damage depends on the cause of the damage.

For example, if the damage is due to a sudden and unexpected event, such as a storm or falling tree, your insurance policy would typically cover the cost of repairs. However, if the damage results from wear and tear, lack of maintenance or gradual deterioration, your policy may not cover it.

Appliance Overflow

If you have a sudden or accidental water overflow from appliances, your dwelling coverage will most likely cover damage repairs. For instance, if your washer is the source of the issue, your policy should cover any personal property damage and damage to the room, including cabinetry and the dryer.

Ice Dams

Ice dams occur when snow melts on the roof and refreezes at the eaves, causing water to pool and potentially leak into the home. Ice dam damage coverage varies depending on the insurance policy and the circumstances. For instance, some policies may cover the resulting water damage to your property, such as interior damage to walls, ceilings or personal belongings. However, the policy might not include repairing the roof damage.

Discuss with your insurance provider about what is covered and not covered under your policy for more details.

See What You Qualify For

Buy A Home

Discover mortgage options that fit your unique financial needs.

Refinance

Refinance your mortgage to have more money for what matters.

Tap Into Equity

Use your home’s equity and unlock cash to achieve your goals.

Types Of Water Damage Not Covered By Homeowners Insurance

Specific types of water damage are outside of typical homeowners insurance policies. In addition to negligence-related incidents, these events aren’t covered:

Floods

Standard homeowners insurance policies exclude coverage for damage caused by floods. Damage resulting from overflowing bodies of water, heavy rain, storm surges or similar flood-related events requires coverage from a separate policy. As a result, additional coverage with flood insurance is advisable for homeowners living in flood zones.

Poor Maintenance Or Intentional Acts

Homeowners insurance policies typically do not cover water damage from poor maintenance or neglect. For example, if a pipe bursts due to lack of maintenance or gradual deterioration, resulting in water damage, your insurance company will deny related claims. Homeowners are responsible for properly maintaining their property to prevent such damage. Likewise, homeowners are liable if they commit intentional destructive acts producing water damage.

Earthquakes And Mudslides

Earthquakes can cause shifting and movement of the ground, leading to pipe damage and subsequent water damage. Similarly, mudslides are “earth movements” insurance policies usually don’t cover. To obtain earthquake-related water damage coverage, homeowners typically need to purchase a separate earthquake insurance policy or an endorsement to their existing policy. This type of hazard insurance is essential for homeowners living in mountainous areas or regions prone to earthquakes.

Sewers And Drains

Sewage or water backing up into a home through pipes, drains or toilets can cause mold, damage walls and ruin your belongings. To obtain coverage for sewer/drain backup, homeowners can usually purchase a separate endorsement or rider to their policy specifically covering this type of damage.

Fund your renovations with a cash-out refinance.

See what you qualify for!

Ways To Prevent Water Damage

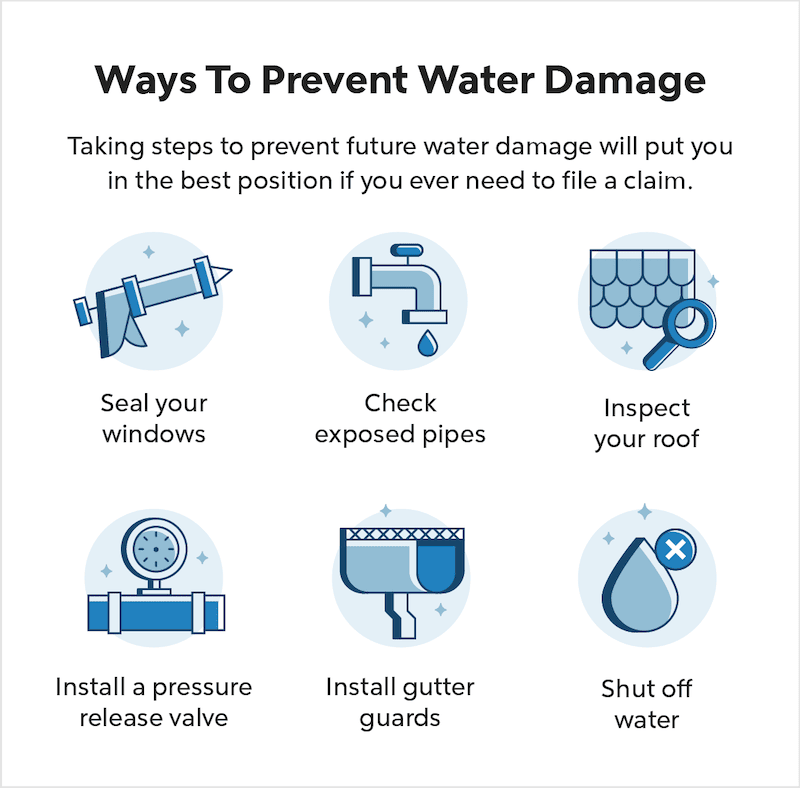

Water damage can be costly and labor-intensive to repair, even when insurance covers it. Therefore, preventing water damage will help you save money and eliminate the hassle of filing insurance claims. Here’s how to avoid water damage:

- Inspect your roof regularly for missing shingles or damage.

- Check exposed pipes for leaks or cracks and replace or repair damaged pipes.

- Install gutter guards to prevent debris from hindering water flow and regularly check and clean downspouts.

- Install an emergency pressure release valve in areas with cold winters to prevent bursting pipes.

- Maintain proper drainage systems, such as sump pumps, to prevent water accumulation around the foundation.

- Repair leaks in plumbing fixtures, pipes and connections promptly.

- Ensure proper sealing around windows, doors and openings to prevent water intrusion.

- Maintain proper ventilation in moisture-prone areas to prevent mold and mildew growth.

- Check and maintain appliances, such as washing machines, dishwashers and water heaters, to prevent leaks.

- Install a water leak detection system that automatically shuts off the main water supply.

- Insulate pipes during cold weather.

- Shut off the main water supply if going on vacation or leaving home for an extended period.

- Regularly inspect the home’s attic, basement, crawl space and cabinets for signs of water damage.

- Add caulking around water fixtures, tubs, toilets and showers to prevent water leakage.

- Remove snow from your roof to avert ice dams.

Start Your Next Home Project Today.

Discover your personal loan options with just a few clicks.

FAQs About Homeowners Insurance Covering Water Damage

These frequently asked questions will help you navigate situations where water damage occurs.

How do I file an insurance claim for water damage?

- Turn off the water in your home to prevent additional damage or make a temporary repair, such as covering a window with a plastic sheet.

- Document which items suffered damage for your insurance claim and remove as much water from the affected area as possible.

- Contact your insurance company, complete all required claim documents and reach out to a claims adjuster for an inspection.

Does homeowners insurance cover water damage from rain?

Homeowners insurance covers specific types of water damage from rain depending on the type of damage and the policy. Generally, homeowners insurance covers water damage caused by sudden and accidental events, such as storm-related damage or roof leaks due to a storm. However, water damage from poor maintenance isn’t covered, and flood damage requires a separate policy or a rider to an existing policy.

Does homeowners insurance cover water leaks?

In most cases, your policy will cover the damage from a water leak if it was caused by a sudden accident, like a broken pipe or faulty water heater. It may not be covered if a lack of maintenance caused the water leak.

The Bottom Line

Homeowners insurance can cover specific types of water damage, such as burst pipes, appliance leaks, firefighting efforts and roofing issues caused by sudden events. Remember, your policy likely excludes poor maintenance, earthquakes, floods and sewer/drain backup. Taking preventive measures, such as regular maintenance, proper sealing and insulation, can help reduce the risk of water damage. If you’re currently dealing with water damage repairs, it’s vital to find out whether homeowners insurance covers mold and other related problems.

Ashley Kilroy

Ashley Kilroy is an experienced financial writer who writes for solo entrepreneurs as well as for Fortune 500 companies. She is a finance graduate of the University of Cincinnati. When Ashley isn’t helping people understand their finances, you may find her cage-diving with great whites or on safari in South Africa.