When looking at real estate taxes and property taxes, what’s the difference? In short, you won’t find one. The IRS uses the term “real estate taxes,” but most people use “property taxes” to refer to the exact same thing. Both terms refer to money paid to state or local governments because of levies on immovable land.

The only important distinction to make is that personal property taxes are different from real estate taxes and property taxes. Personal property taxes refer to movable properties, like the car you drive to work. These items are taxed differently from real estate.

Let’s take a deeper dive into how these taxes work and put an end to any confusion surrounding these real estate terms.

Real Estate Tax Vs. Personal Property Tax

Before going any further, it’s important that we first take a moment to explain in greater detail whether real estate taxes are the same as property taxes and the role of personal property tax in real estate dealings.

What Are Real Estate Taxes?

Real estate taxes are government-levied payments charged annually on immovable land, also known as real property. Immovable land is just that – land or property you can’t physically move. It usually refers to buildings, homes or land plots.

These taxes are paid to local or state governments to fund schools, community projects, infrastructure or other undertakings. You can pay real estate taxes directly to a local tax assessor or indirectly through your monthly mortgage payments by way of an escrow account.

Many people refer to real estate taxes as property taxes. That’s because these terms have the same meaning. The only time a distinction should be made is in the case of personal property.

What Is Personal Property Tax?

Personal property tax isn’t the same as property tax. Personal property taxes are paid on movable items you own – like boats, vehicles, RVs or planes. The portion of your annual vehicle registration based on the vehicle’s value is one form of personal property tax.

This tax is paid on the local or state levels. Some areas don’t require you to pay personal property tax at all. Those areas that do generally require it be paid annually when you file tax returns. Personal property taxes usually fund public works projects, like schools and roads.

See What You Qualify For

Buy A Home

Discover mortgage options that fit your unique financial needs.

Refinance

Refinance your mortgage to have more money for what matters.

Tap Into Equity

Use your home’s equity and unlock cash to achieve your goals.

Real Estate Tax Vs. Property Tax Vs. Personal Property Tax

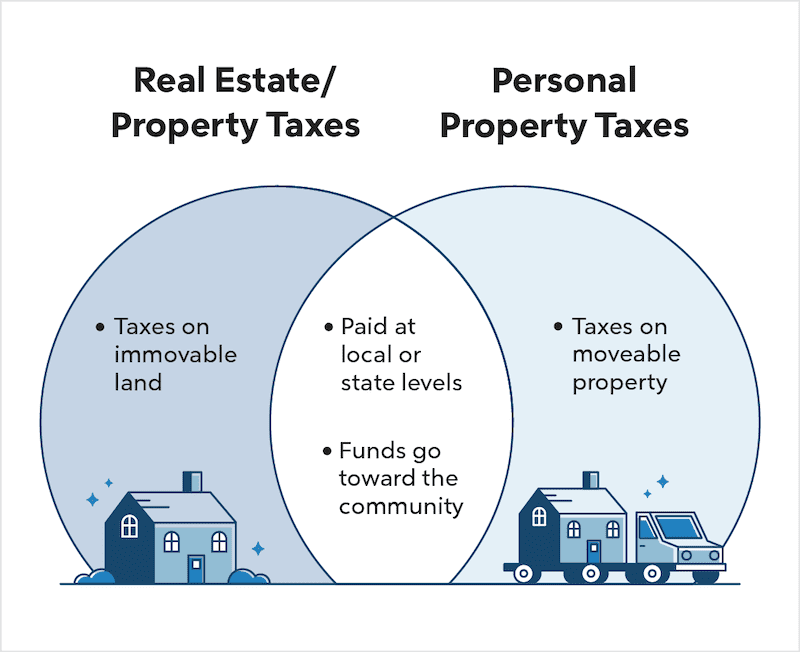

So are real estate taxes the same as property taxes? In short, yes. When referring to immovable assets like a home, real estate taxes and property taxes are synonymous. Personal property taxes, however, carry a different meaning.

Here are a few ways these terms compare and contrast:

- Property taxes and real estate taxes both refer to levies on immovable property, also known as real property.

- Personal property taxes refer to levies on movable property, like boats, vehicles and planes.

- The IRS uses the term “real estate taxes,” while consumers often use the term “property taxes.”

- Personal property and real estate taxes are both paid at the state or local levels.

- Personal property and real estate taxes both usually go toward funding community projects. Examples include schools, roads and infrastructure.

Is A Vehicle Considered Real Property?

Vehicles are considered real property when they’re attached to the ground, as in the case of a mobile home anchored using steel straps. Here, the property is immovable, and you’ll pay real estate taxes.

However, if a vehicle – like the car you use to drive to work – isn’t attached to the ground, it isn’t considered real property. Movable vehicles are considered personal property and are taxed as such. These movable “vehicles” include mobile homes that are unattached to the land.

How Much Are Property Taxes?

Property taxes vary from state to state (as well as local areas inside each state). According to the National Association of REALTORS®, owners of single-family homes paid a national average of $3,901 in property taxes in 2022. That means around $325 of each month’s mortgage payment went toward property taxes. Some states have property taxes lower than 0.5% of the home’s assessed value, while others have rates higher than 2%.

To see where your state stacks up, take a look at these estimates of property taxes by state. If you’d like the most accurate view of property taxes in your state, you can also use a local property tax estimator found on your state or county website. Because property taxes are calculated based on the home’s assessed value each year, you can also calculate your own estimate using this formula:

Property Taxes = Assessed Value x Tax Rate

When paying property taxes, you may wonder about a common point of confusion: Are property taxes paid in advance or in dues? The answer is often both. If a tax year runs January through December but property taxes are due in November, you’ll effectively be paying 10 months in dues and 2 months in advance.

The Bottom Line

Oftentimes, when people say “property tax,” they mean real estate tax, the official term used by the IRS. These property taxes are typically bundled into your monthly mortgage payment. Personal property tax, however, often refers to moveable assets, like cars, boats and RVs, all of which are taxed in your annual registration fees. Property taxes may feel like a burden, but they’re an important part of our communities. Without these funds, key community features like schools or libraries could suffer.

See What You Qualify For

You can get a real, customizable mortgage solution based on your unique financial situation.

Victoria Araj

Victoria Araj is a Staff Writer for Rocket Companies who has held roles in mortgage banking, public relations and more in her 15-plus years of experience. She has a bachelor’s degree in journalism with an emphasis in political science from Michigan State University, and a master’s degree in public administration from the University of Michigan.