The percentage of unmarried couples buying homes increased in 2021 from 2013, with the largest percentage of them being Gen Z and millennials, ages 22 – 30. As more and more couples buy homes before marriage, the question becomes: Is it a good idea?

Learn more about the pros and cons of committing to a mortgage before committing to marriage and see if it may be the right choice for you.

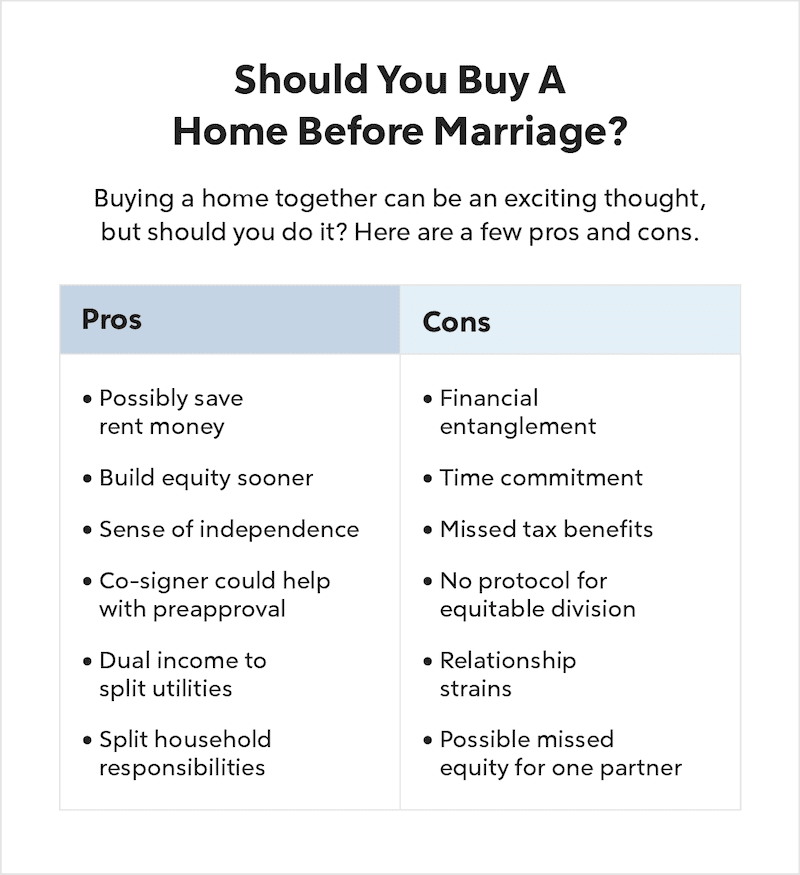

Pros And Cons Of Buying A House Before Marriage

Whether you’re married or not, many of the pros and cons of buying a home will apply to your situation. But buying a house before marriage has some unique advantages and disadvantages. If you’re thinking about buying a home with your partner before tying the knot, be sure to consider these points:

Pros

Buying a home as an unmarried couple may offer these benefits:

- Possibly save rent money: Rent can be just as expensive or more expensive than a mortgage payment. Depending on your market, your rent may climb every year. On top of that, living separately means two rent payments. Combining your living costs into one mortgage may bring significant savings.

- Build equity sooner: Getting into a home sooner means you can start building equity sooner. Start building equity as the home appreciates and you’ll pay off your monthly mortgage payment.

- Sense of independence: Whether you’re moving out for the first time or lived on your own for a while, buying a home can produce a sense of independence. It’s an achievement many people look forward to.

- Co-signer can help with preapproval: If you move forward with a joint application, having your partner on the loan application may help with preapproval. Your partner’s additional income may help you qualify for a mortgage with a lower rate.

- Dual income to split utilities: Saving on living costs is a smart financial decision. When you move in together, you can split more than your mortgage payments. You can split utilities, too.

- Split household responsibilities: Get buy-in from your partner to help you cook or clean. When you split time-consuming household chores, you both save valuable time.

Cons

Unfortunately, you may experience these drawbacks:

- Financial entanglement: Getting a mortgage with your partner can put a financial strain on the relationship. Before combining your finances, make sure you’ve talked about money. Discuss your finances and set clear expectations, especially if one of you earns more than the other.

- Time commitment: Many mortgages are 30-year commitments, with no easy way out of the obligation. This time commitment may be problematic if the relationship goes south.

- Missed tax benefits: Married couples receive several tax benefits you may miss out on if you file as single. For example, married couples filing jointly can deduct up to $10,000 of property taxes. Single filers can only deduct up to $5,000.

- No protocol for equitable division: Married couples may have more legal protections if the relationship doesn’t last. The laws that require an equitable division of assets during a divorce are practically nonexistent for unmarried couples who break up.

- Relationship strains: Buying a home together may strain your relationship for countless reasons. For example, if your partner insists on flipping every light switch on, and you can’t turn them off fast enough, your ballooning light bill will only fuel your irritation. Eventually, things will break and your home will need repairs. If one partner feels the other isn’t contributing to the home’s maintenance, that can also cause stress.

- Possible missed equity for one partner: If a couple buys a home together but only one person’s name is on the mortgage and title, the other person may miss out on equity. Contributing to monthly mortgage payments without the security of being on the title may lead to resentment.

See What You Qualify For

Buy A Home

Discover mortgage options that fit your unique financial needs.

Refinance

Refinance your mortgage to have more money for what matters.

Tap Into Equity

Use your home’s equity and unlock cash to achieve your goals.

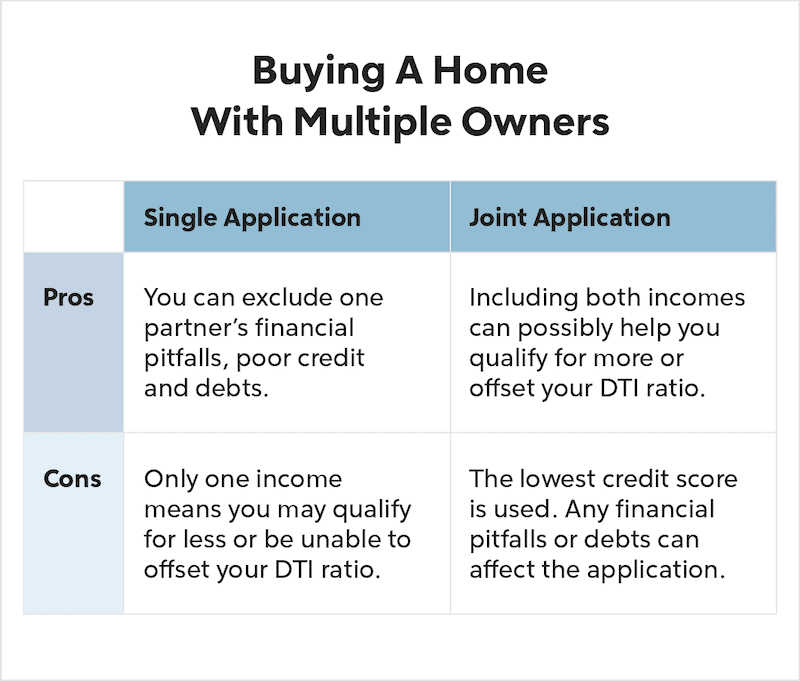

Ways To Apply For A Mortgage As An Unmarried Couple

Qualifying for a mortgage and buying a home with your partner is similar to buying a home on your own. Marital status doesn’t affect your ability to qualify for a mortgage. Whether you’re married, unmarried or single, qualifying for a mortgage will depend on your income, credit and assets.

The only fundamental differences when buying a house with multiple owners are the mortgage application and property rights. You can file your mortgage jointly or as an individual, and both approaches have advantages and disadvantages.

Single Applications

The responsibility of getting approved and repaying the mortgage will fall to the partner whose name is on the mortgage application. That person’s income, debts, credit and assets will be the only financial information that matters to your lender.

Pros Of A Single Application:

- If your credit score is significantly higher than your partner’s, filing as a single applicant, and not a couple, may help you qualify for a better mortgage interest rate.

- If your partner’s financial history includes events like bankruptcy and yours is pristine, filing as a single applicant means your lender only considers your financial history.

- If your partner doesn’t make a steady income or has gaps in their employment history and you don’t, filing as a single applicant will strengthen your mortgage application.

- If you have substantially lower debt than your partner and file as a single applicant, your lender will only review your debt-to-income ratio (DTI). A low DTI ratio may help you qualify for a bigger

Cons Of A Single Application:

- As a single applicant, you won’t be able to pool your partner’s income with yours to buy a home, which diminishes your purchasing power.

- If you have significant debts, your partner’s income can’t be used to help offset your high debt-to-income ratio, which may hurt your chances of qualifying for a loan or getting favorable loan terms.

Joint Application

In a joint application, qualifying for and repaying a mortgage falls on both applicants. Both applicant’s income, debts, credit histories and assets will affect the mortgage application.

Pros Of A Joint Application:

- If both credit scores are similar and meet a lender’s requirements, that will strengthen your application.

- If your combined financial histories don’t show negative events, like bankruptcy, there won’t be any negative consequences for the application.

- If your combined debt-to-income ratio is lower than a single applicant’s DTI ratio, you may qualify for better interest rates and a higher mortgage.

- Because you’re combining both incomes, you may be able to afford a more expensive home.

Cons Of A Joint Application:

- A lender will consider both credit scores when determining loan eligibility. They’ll base their decisions on the lower credit score, which may hurt your chances of qualifying for a

- The lower credit score will be the deciding factor that determines what interest rate the lender offers. The lower the score, the higher the interest rate you may pay.

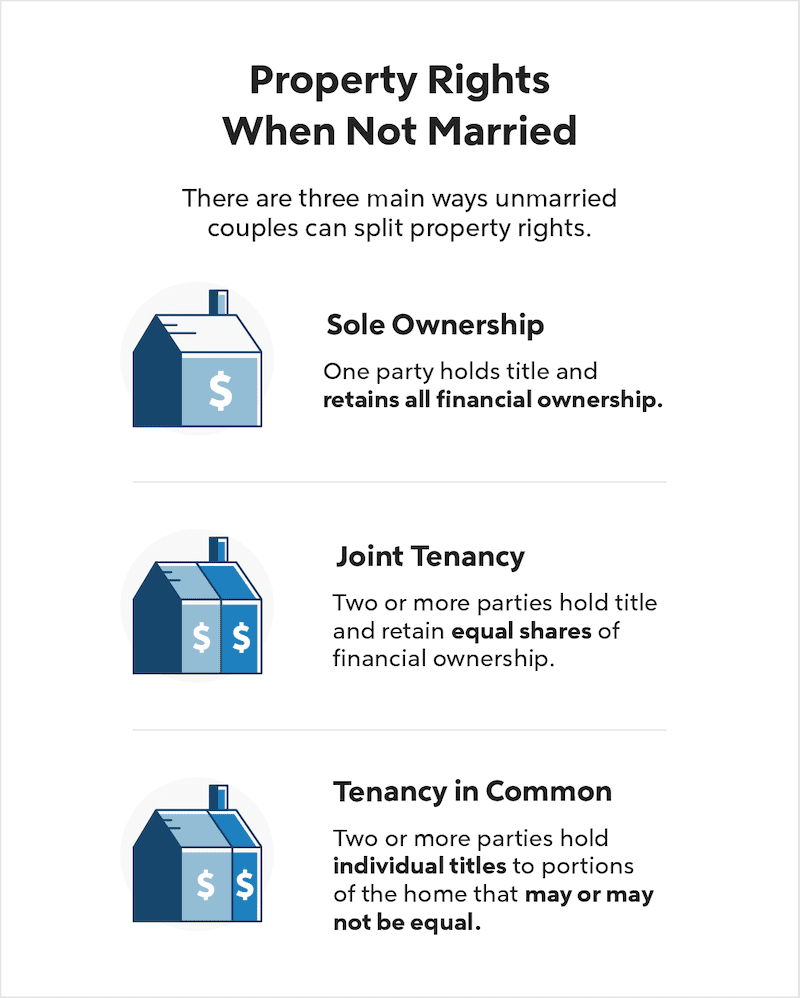

How Do Property Rights Work For Unmarried Couples?

A mortgage application is separate from property rights. So, whether you file jointly or there is only one name on the mortgage application, both partners can hold the title however they wish. One person or both of you can be on the title.

When recording your title as an unmarried couple, you can split property rights in one of the following ways:

Sole Ownership

With sole ownership, one person is on the title, and they retain the rights to the property.

Pros

- You don’t need permission from anyone to sell or refinance the home.

- If a partner doesn’t want the financial obligation of homeownership, they can opt out and not be legally tied to the home.

Cons

- If the owner dies without a will, also known as intestate, transferring property can be difficult. The will must go to probate, which can be lengthy and frustrating for surviving partners.

- Even if everyone in the partnership contributes to the monthly mortgage payments, only one person will build

Joint Tenancy

Under joint tenancy, two or more people are on the title. All parties receive equal rights and shares in the property’s equity. In the event of death, ownership automatically passes to the surviving co-owner(s).

Pros

- The financial burden is shared equally, and everyone builds

- In the event of death, probate isn’t necessary. Ownership is automatically transferred to the surviving co-owner(s).

Cons

- All owners must approve before refinancing or selling the property.

- When a co-owner dies, ownership of their shares passes to the surviving co-owner(s) by default. A co-owner can’t leave their shares to an outside beneficiary.

- If one owner faces legal judgment for debt collection, a creditor can petition the court to force a home sale to pay the debt.

Tenancy in Common

Under tenancy in common, two or more individuals can have a vested financial interest in the home, but it doesn’t need to be equal. Each owner holds the title for a portion of the home.

For example, one partner may own 60% of the home, and the other owns 40%. Each owner can transfer their portion of the title to anyone they choose. So, in this example, a beneficiary would own either 60% or 40% interest in the property.

This type of property ownership refers to financial gain, not living space. With tenancy in common, both parties have equal rights to inhabit and enjoy the entire home.

Pros

- If one partner pays more of the monthly mortgage, equity can be divided accordingly. Each party can use their portion of wealth from the property as they see fit.

- An owner won’t face any threat to their interest in the property if a creditor places a lien on another owner’s interest.

- Because each owner holds their own title, transferring ownership is simpler than in a joint tenancy.

Cons

- Automatic survivor rights are not in If one owner dies, their portion of the home will face the same lengthy probate process associated with sole ownership.

- All owners are liable for debts associated with the If one owner doesn’t pay their share of property taxes, for example, the other owners would be responsible for covering their part of the bill.

Tax Implications When Buying A Home Before Marriage

Married couples usually benefit more than unmarried couples from a tax standpoint. It isn’t always the case, but it is likely.

If you’re buying a home as an unmarried couple, consider the following tax implications:

Mortgage Interest Deduction

Unmarried and married couples that file their taxes jointly can deduct up to $750,000 in mortgage interest. Married couples that file separately can deduct up to $375,000 individually.

Filing for the mortgage interest deduction when you’re an unmarried couple can get complicated. First, each partner must make itemized deductions rather than take the standard deduction.

The IRS recommends taking a deduction for your portion of home-related expenses. For example, if you split the mortgage and property taxes evenly down the middle, each partner can claim half of the total amount paid as deductions on their tax return.

You’ll both need to attach a statement to your tax return explaining how your mortgage interest and real estate taxes are divided. You’ll also need to keep records of how you split the deductions for the IRS mandatory review period since the reported information won’t match records submitted to the IRS.

Capital Gains Taxes

When you sell your home and make a profit, you pay capital gains tax on that profit. The IRS allows you to deduct $250,000 in capital gains as a single person or $500,000 as a married couple.

Unmarried couples can each take up to a $250,000 capital gains exclusion on their individual tax returns. To be eligible for the exclusion, the couple must have owned and lived in the home for at least 2 of the 5 years before the resale.

Standard Vs. Itemized Deductions

As of 2018, married couples need more than $25,900 in deductions to make itemizing worthwhile. Individuals need more than $12,950 (or $19,400 if filing as head of household). In this tax scenario, married and unmarried couples are on relatively equal footing.

Drafting A Cohabitation Agreement

A cohabitation agreement is a legal contract that outlines critical financial and legal considerations for unmarried couples who live together. The end of your relationship may be the last thing on your mind, but if it happens, a cohabitation agreement can protect everyone.

While married couples are legally entitled to the equitable division of assets, unmarried couples aren’t. A cohabitation agreement provides a legal safety net.

It’s best to draft your cohabitation agreement before emotions start to influence tough decisions. Ask a real estate attorney to help you craft an agreement everyone deems fair.

Here are a few questions you may need answered:

- Who is financially responsible for what? Who pays or how do you split property taxes, mortgage payments, HOA fees, homeowners insurance, utilities, repairs, etc.?

- If you separate, what happens to the property? Will it be sold? Can you buy your partner out and vice versa?

How will you divide the proceeds if you make a profit from selling the property?

FAQs: Buying A House Before Marriage

If you’d like to buy a home before marriage, you may find yourself contemplating the following questions:

Should both partners be on the house title?

Whether or not you both should be on the house title is a personal decision. If one partner was on the mortgage application and makes all payments, it may be best to have the title in their name. However, if both of you are contributing to the property financially, it may make sense to have both of you hold title through joint tenancy or tenancy in common.

What happens to property owned before marriage?

Any property acquired by one person before marriage is generally considered separate property. In case of divorce, the property usually returns to the original owner.

Depending on how the title is held, property acquired before marriage as an unmarried couple may or may not be considered joint property. If the property acquired before marriage held title through sole ownership, it usually remains the original owner’s property.

Who gets the house when an unmarried couple splits up?

When an unmarried couple splits up, there are generally two courses of action:

- Go to court.

- Work it out between yourselves.

In court, the decision will depend on several factors, including how the title is held. Often, the resolution involves selling the property and dividing profits accordingly. If the cohabitation agreement indicates who gets the house in case of a breakup, the couple will follow the agreement’s stipulations.

Is it better to be married when buying a house?

Marital status doesn’t influence whether you qualify for a mortgage, so there is no benefit to being married during the home buying process. However, married couples have more legal protections than unmarried couples in case they separate. A cohabitation agreement outlining what happens if you break up is advisable for unmarried home buying couples.

The Bottom Line

Buying a house before marriage is a big decision that will impact your finances and relationship. Before saying “I do” to a home purchase, weigh the pros and cons with your partner. Set clear expectations and use a real estate attorney to draft a plan that addresses everyone’s needs and concerns.

If you’re ready to start your home buying journey, .

See What You Qualify For

You can get a real, customizable mortgage solution based on your unique financial situation.

Victoria Araj

Victoria Araj is a Staff Writer for Rocket Companies who has held roles in mortgage banking, public relations and more in her 15-plus years of experience. She has a bachelor’s degree in journalism with an emphasis in political science from Michigan State University, and a master’s degree in public administration from the University of Michigan.