Most of the time, private property purchases are pretty straightforward: An individual or family finds a property they’re interested in, they go through the sales process and purchase it, and it’s all good.

But there are instances where it’s a little more complicated, and tenancy in common (TIC) can be a good solution. In tenancy in common, two or more owners of a home or other type of real property enjoy equal rights to the property. To find out if this is a good fit for you, let’s do a deeper dive into the concept of tenancy in common.

What Is Tenancy In Common?

Tenancy in common is a type of property co-ownership in which several people own a property together. Two or more owners of a home — or another type of real property — enjoy rights to all of the property, even if they own different percentages of the property.

Tenancy in common agreements are commonly used in situations in which multiple people want to own a property together. For example, friends who want the benefits of house ownership but don’t have the money for an initial purchase can pursue tenancy in common because they can combine their assets and incomes on applications. Similarly, friends may choose TIC if they want to buy a vacation property together but are interested in different levels of investment and usage rights.

See What You Qualify For

Buy A Home

Discover mortgage options that fit your unique financial needs.

Refinance

Refinance your mortgage to have more money for what matters.

Tap Into Equity

Use your home’s equity and unlock cash to achieve your goals.

How Does Tenancy In Common Work?

Tenancy in common can be a confusing concept, so let’s look at an example. Let’s say that a property has three owners via TIC:

- Person A owns 50%

- Person B owns 25%

- Person C owns 25%

All three owners can use all parts of the property equally. Because they have full ownership rights over their percentage, they can:

- Dispose of their ownership

- Borrow against the equity they have in their percentage of the property

- Engage in estate planning that bequeaths their property share to an heir

Each owner has control over their specific share. So if Person C wanted to sell their property to someone else, Person A and Person B would not have a say in Person C’s decision.

How To Become Tenants In Common

Multiple people buying a property together can help during the mortgage approval process because they can combine their income and assets to qualify for the loan and make a larger down payment.

But in order to create a harmonious situation, tenants in common must decide how their ownership interest will be divided. If all owners contribute equally to the purchase, for instance, they might decide upon equal shares. For example, if four friends buy a house together, they could each take a 25% share in the property.

Or they might decide to go with unequal shares if one person can contribute more to the purchase than another, so one friend might have a 50% share, another a 30% share, while the other two both take a 10% share.

How To Abide By A Tenancy In Common Agreement

A critical point of the tenants in common situation is that all tenants have a right to the entire property — regardless of the size of their individual shares.

So, if you and your partner have joint tenancy as tenants in common and you both have a 50% share in the real estate, you both still have a right to the entire property — you don’t have to physically split up the home and determine who gets each half of the home. Your property ownership interest just means that when you sell the home, you’re both entitled to 50% of the proceeds.

Relatedly, you both have the right to do as you wish with your interest in the home. You can sell or gift it to someone else or bequeath it to an heir in your will.

Keep in mind, however, that when it comes to certain debts and obligations, such as property taxes, your individual ownership interest doesn’t protect you from default. Indeed, all tenants in common may be fully liable if one person stops paying.

Consider this example:

- Three people buy a home together, all signing on as co-owners on the mortgage.

- Mary has a 50% share in the property, while John and Jane both have 25% shares.

- If Mary decides to skip town and stop paying her part of the mortgage, John and Jane will still be fully liable for the loan.

- If they don’t make their monthly payments in full, the house could be foreclosed.

How To Dissolve A Tenancy In Common Agreement

Co-owning a property can sometimes be fraught, and differences may be irreconcilable. If you and your co-owners can’t agree on what to do with a property, you may find yourself needing to get out of your tenancy in common arrangement.

This can happen when a group of siblings inherits a property as tenants in common, or when a married couple with this type of ownership divorces.

If you want to terminate or leave your tenancy in common, you’ll typically need to either sell your share (either to the remaining co-owners or to someone who will then replace you in the tenancy in common) or sell the home.

If your co-owners don’t agree to selling the home, you can file a partition action, which asks the court to divide the property up among the co-owners. If you’re trying to divide property that can’t be physically split up (such as a home), the court will order the sale of the property and the proceeds will be divided according to ownership interest.

For example, Kate, Hannah and Polly co-own their home. Polly has decided that she’d like to move out and take the cash associated with her share to purchase another home. However, Kate and Hannah like living together and don’t want to sell their home.

Here are some possible scenarios:

- Kate and Hannah might consider buying out Polly’s share. So, if she has a 50% share on a home that’s valued at $200,000, they’ll pay her $100,000 to buy out her interest.

- Kate and Hannah don’t have enough cash to buy Polly out and Polly is anxious to leave. Polly tries to find someone who will buy her share and take over her ownership interest — meaning that this new person would become co-owners with Kate and Hannah.

- Kate and Hannah refuse to put the home up for sale, so Polly files a partition action, asking the court to force the sale of the property.

- Polly decides she wants to continue living in the home, but by herself as the sole owner. Kate and Hannah agree to sell Polly their shares, and Polly becomes the sole owner of the property.

Find A Mortgage Today and Lock In Your Rate!

Get matched with a lender that will work for your financial situation.

Tenancy In Common Vs. Other Types Of Co-Ownership

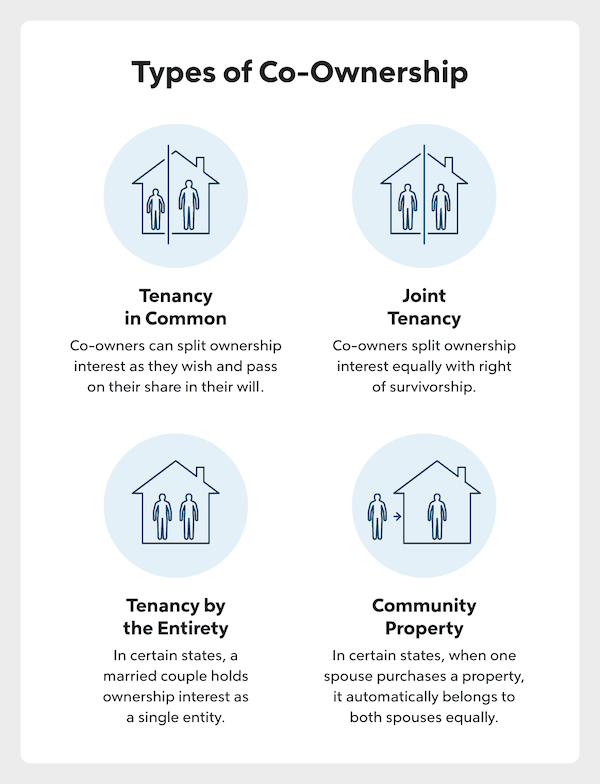

There are a few different ways you can co-own a property with one or more people, and choosing the right type depends on your goals and needs. When a property has multiple owners, their rights as co-owners are referred to as their ownership interest, or just interest, in the property.

Unlike some other types of co-ownership, however, tenancy in common doesn’t include right of survivorship. In other words: when you die, your ownership share will go to your estate and be passed on to your heirs, rather than being passed to the surviving co-owners.

Other types of co-ownership include:

- Joint tenancy: two or more people own equal shares of a property

- Tenancy by the entirety: a type of ownership utilized by married couples in some states that allows them both to hold 100% interest in the property as a single, legal entity

- Community property: a type of ownership utilized by married couples in states that have community property laws, which dictate that any property purchased by one spouse during a marriage belongs equally to both spouses

Tenancy In Common Vs. Joint Tenancy

Tenancy in common divides ownership any way the tenants would like, while joint tenants share equal ownership and have the right of survivorship. In the latter arrangement, if an owner dies, their interest is automatically passed to the remaining co-owner.

For this reason, joint tenancy tends to be popular with married couples. However, if you’d prefer that your ownership interest pass along to your heirs, tenancy in common would likely be a better choice for you.

Tenancy In Common Vs. Tenancy In Severalty

Tenancy in common refers to a property owned by several people, while tenancy in severalty means a property only has one owner. The term “severalty” is derived from the concept that an owner is “severed” from other owners.

Tenancy In Common Vs. Tenancy By The Entirety

Tenancy by the entirety is a type of property ownership only available to married couples. Under this type of ownership, both spouses jointly own the property as a single, legal entity, and each spouse also has survivorship rights.

Also, tenancy by the entirety doesn’t mean both spouses have a 50/50 claim to the property. Rather, both individuals own a 100% stake in the home, both individuals are named on the property deed and both spouses share ownership interest — and control — of the property.

Tenancy In Common Vs. Community Property

Because tenancy in common applies specific percentages, it’s a good way for friends or business partners to divide specific shares of real property. Community property, on the other hand, is a standard that applies to married couples in some states. In this particular situation, any property that a couple acquires during their marriage is considered community property, meaning that it’s owned equally by both spouses. Each spouse has the right to manage and control the community property, but they can’t sell or transfer it without the other spouse’s consent. If one spouse dies, their share of the community property passes to the surviving spouse.

Advantages Of Tenancy In Common

As described, there are many benefits to the tenancy in common arrangement, including full rights to the entire property regardless of percentage of ownership. Other pluses include:

- Freedom to sell your share of the property: By using tenancy in common, each owner has the right to sell their share of the property without needing the other owners’ consent. This provides a high degree of flexibility and allows owners to sell their investment whenever they choose.

- Control over who inherits your ownership interest: When it comes to estate planning, each owner can choose who they want to inherit their share. This enables owners to have a greater degree of control over their estate and ensures their interests are passed on to their heirs.

- Flexibility of ownership percentages: Tenancy in common allows the ownership percentages to be divided equally — or unequally — among owners, providing a direct correlation between financial involvement and how much each owner contributes to the property upkeep.

- Potential to make the mortgage process easier: A group combining financial assets can amass a larger down payment, thereby possibly securing a lower principal. Also, if one owner has a higher credit rating, the group may be able to secure a better mortgage rate.

Disadvantages Of Tenancy In Common

The tenancy in common arrangement also brings some disadvantages for its participants. They include:

- No right of survivorship: If one owner in a tenancy in common situation passes away, their share of the property does not automatically pass to the surviving owners. Instead, it’s passed on to the owner’s heirs, which can lead to complications.

- Co-owner’s shares may be sold to someone you don’t know: An owner in a tenancy in common arrangement can sell their share at any time, meaning that a previously unknown co-owner may be introduced to the other tenants.

- A partition action can potentially force a sale: A disagreement can lead to a partition action, in which owners may be forced to sell their share of the property — even if they don’t want to.

- Combined financial responsibility can lead to complications: If one tenant defaults on mortgage payments, the other tenants are responsible for making up the difference.

Find A Mortgage Today and Lock In Your Rate!

Get matched with a lender that will work for your financial situation.

Tenants In Common: FAQs

Here are some answers to the most commonly asked questions about tenancy in common.

Who pays property taxes in a tenancy in common agreement?

Each co-owner is jointly responsible for paying property taxes, and the amount of taxes is based on individual ownership percentage.

What happens if a tenant in common dies?

If an owner in a tenant in common arrangement passes away, their share of the property goes to whoever has been named as an heir. The remaining tenants in common still own their respective shares in the property, and the new owner can either sell their share or become part of the tenancy in common agreement.

Can tenants in common force a sale?

Tenants in common can only force a sale of the jointly owned property under certain circumstances, such as if the majority of the group is also interested in selling. If other co-tenants do not agree to the sale, the co-tenant who wishes to sell can petition the court for a partition of the property.

What happens if a tenant in common refuses to sell?

The property’s other owners may need to file a partition action in court to force the sale of the property, or to divide the property among the owners. This can be a time-consuming and costly legal process.

Can I buy out a tenant in common?

Yes, you can buy out a tenant in common, but you will need to negotiate a price based on ownership percentage and market value.

The Bottom Line

At first blush, tenancy in common may not seem like the most intuitive arrangement. But it works very well for people in different circumstances — for instance, it can be a beneficial situation for close friends, families or business partners.

Whether you’re buying your own property or looking to collaborate on an investment, take action and today!

See what you can afford.

Quicken Loans® can help you find a lender.

Joel Reese

Joel is a freelance writer who has written about real estate, higher education, sports and myriad other subjects. He has been published in The Best American Sports Writing series, Details, Spin, Texas Monthly, Huffington Post, Chicago magazine and many other outlets. His website, ReeseWrites.net, features several samples of his work.