Most people who buy a home take out a mortgage to finance the purchase. There is an approval process called underwriting that stands between a borrower wanting a property and them being able to pay for it. Let’s dive in and learn more about underwriting and how it works.

What Is Underwriting?

Underwriting is the process your mortgage lender goes through to evaluate your assets, debt, credit and property details. Underwriting is a way for lenders to mitigate risk by making sure borrowers can afford to repay their mortgages. They also determine if the home will be worth enough to cover the mortgage loan should the borrower default. Underwriting dictates whether an individual gets final loan approval.

See What You Qualify For

Buy A Home

Discover mortgage options that fit your unique financial needs.

Refinance

Refinance your mortgage to have more money for what matters.

Tap Into Equity

Use your home’s equity and unlock cash to achieve your goals.

What Does an Underwriter Do When They Underwrite a Mortgage?

A mortgage underwriter is a financial professional who evaluates a borrower’s loan application and finances to assess how much risk a lender will take on if they decide to give the borrower a loan. This is important for lenders. If a borrower is getting a mortgage, it’s the job of the underwriter to verify that all the information the borrower has provided is true and accurate. From a borrower’s perspective, when an underwriter underwrites a mortgage, they’re essentially reviewing, evaluating and assessing a variety of factors to determine their ability to repay the loan through monthly payments. Ultimately, the underwriter will ensure that an individual does not close on a mortgage that they cannot afford.

To do this, the underwriter assigned to an individual’s application will order a detailed appraisal of the property a borrower wishes to buy to make sure that the amount being financed with the requested loan size is not more than the home’s value. They’ll also verify, evaluate and analyze the applicant’s income, employment situation, current assets and liabilities and order a credit report. An underwriter is assessing the financial stability of the borrower applying for a loan and decides whether to finally approve their loan based on these factors.

- Credit report: Underwriters review a borrower’s credit report in order to assess their creditworthiness and determine whether to approve their loan application. They look at their overall credit score, a key factor in loan underwriting, and review things like late payments, bankruptcies and overuse of credit.

- Debt-to-income ratio (DTI): A DTI is a percentage that tells lenders how much money a borrower spends on monthly debt payments versus how much money they have coming into their household to ensure they have more than enough cash flow to cover monthly mortgage payments, taxes and insurance. Underwriters look at a borrower’s DTI to assess their ability to repay a loan on time and in full. They need to be able to review any documents showing how much debt a borrower owes, in the form of car payments, student loans, credit card debts or other liabilities. Too much debt relative to a borrower’s income is a strong indicator of future financial difficulty.

- Down payment: Underwriters look at a borrower’s savings accounts when assessing their ability to obtain a loan to make sure they have enough to use as a down payment at closing or to supplement their income.

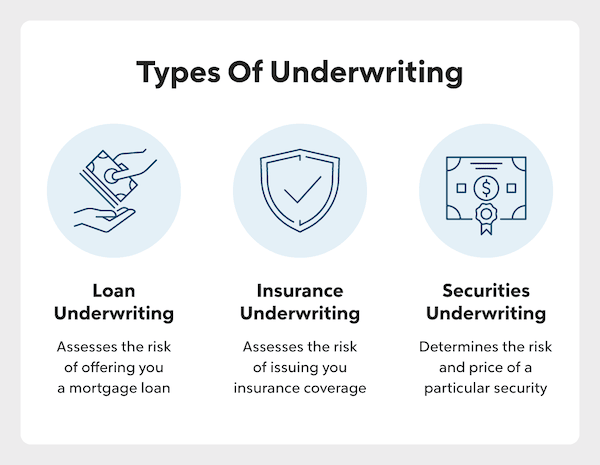

Types Of Underwriting

While underwriting is often associated with mortgages, several types of underwriting are used in different industries for different purposes. Underwriting is a common practice used in the commercial, insurance, and investment banking industries.

Loan Underwriting

The most common type of loan underwriting is for mortgages. Loan underwriting is the process of evaluating a borrower’s financial situation to determine their creditworthiness and assesses the risk of offering them a loan. The mortgage underwriting process is like other types of loan underwriting, but there are some key differences.

If a lender denies a mortgage application, a borrower can find out why. Lenders are legally required to tell a borrower why an underwriter denied their application if their credit played a role. If a borrower is not sure about the reason, they should contact their lender directly in order to figure out their next steps. If a lender approves a borrower without conditions, there’s nothing else a borrower needs to do besides scheduling their closing with the lender.

However, a borrower may need to provide more information if their approval comes with conditions or if their application is suspended. Loan underwriting is necessary for several reasons, including compliance. It’s often required by law or regulation to ensure compliance with various financial and consumer protection laws.

Insurance Underwriting

Insurance underwriting and loan underwriting are two distinct processes with different objectives, although they share the same concept. Insurance underwriting instead assesses the risk of a person seeking life, health or property insurance. It’s the process of evaluating and assessing the risk of insuring a person, organization, asset, event or property, and determining the appropriate premium to charge for the insurance policy to cover that risk. Insurance underwriters are professionals who evaluate and analyze the risks involved in insuring people and assets.

Insurance companies use underwriting to evaluate an applicant’s likelihood of experiencing a loss, such as damage to property, illness or injury, and to assess the potential cost of that loss. While a loan underwriter will assess factors like credit history, a life insurance underwriter will also assess the risk of a potential policyholder to the lender by evaluating their age, health, medical history, occupation, lifestyle and other factors.

With health insurance underwriting, an underwriter will review medical details. For instance, if an individual is a younger, healthy person with a low-risk lifestyle, they may be less expensive to cover.

Securities Underwriting

In the securities market, underwriting is a bit different, as it involves assessing the risk and the appropriate price of certain securities – most often related to an Initial Public Offering (IPO). It’s performed on behalf of a potential investor, often an investment bank. Based on the results of the underwriting process, an investment bank would buy or underwrite securities issued by the company attempting the IPO, and then sell those securities in the stock market. The securities underwriter helps a company or organization raise money from investors by determining the value and risk of bonds, stocks or other financial instruments.

This ensures that the issuers of the security can raise the full amount of capital while earning the underwriters a premium or profit in return for their service. Investors benefit from the vetting process that underwriting provides and its ability to make an informed investment decision.

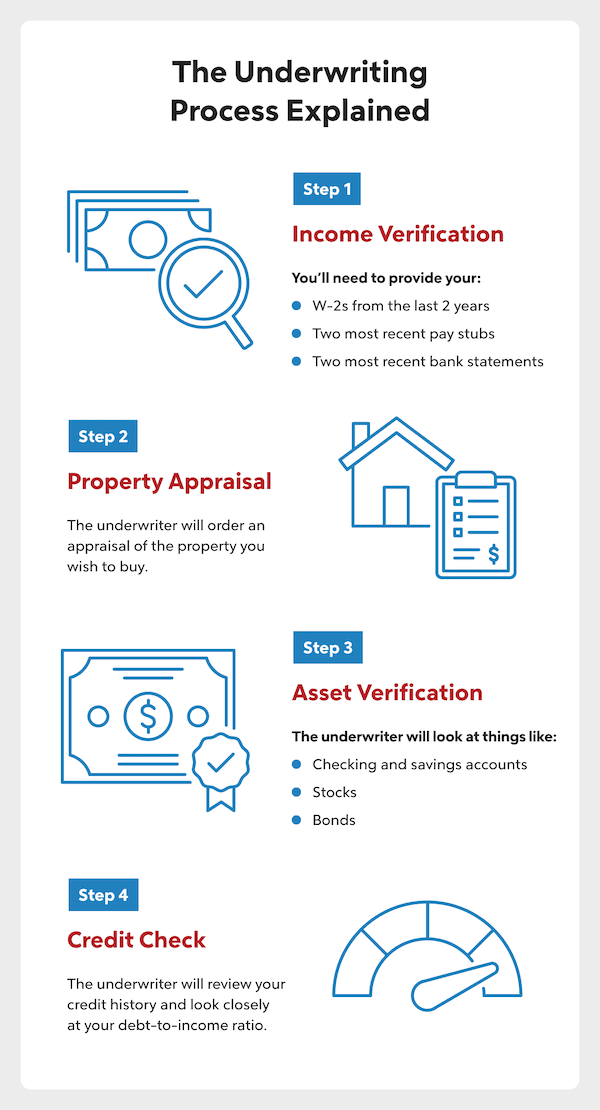

How The Mortgage Underwriting Process Works

The mortgage underwriting process is the step-by-step evaluation of a borrower’s financial and credit profile to determine their eligibility for a mortgage loan. What are underwriters looking for? As discussed above, a mortgage underwriter assesses the level of risk a borrower presents to a potential lender by looking closely at their income, property, assets, and credit. These are key pillars of any mortgage approval.

Underwriters will confirm a borrower’s income and verify employment. There are three types of forms a lender will typically ask for and require verifying a borrower’s income:

- W-2s from the last 2 years

- Two most recent pay stubs

- Two most recent bank statements

If a borrower is getting a mortgage while self-employed or has more than 25% ownership in a business venture, the lender will require different documentation. The requirements may vary depending on the type of loan a borrower is applying for, the lender’s policies and the borrower’s financial situation. These are some of the documents commonly requested:

- K-1s

- Balance sheets

- Profit and loss statements

- Business and personal tax returns

Property Appraisal

While the underwriting process is happening, the lender will order an appraisal, typically conducted by a licensed appraiser, to assess and evaluate the property a borrower wishes to purchase. This is to make sure the amount the lender provides for the home matches up with how much the home is worth (also known as the fair market value of the property). This is often required when refinancing if the value cannot be verified another way and is always required for home purchases.

Asset Verification

During the underwriting process, underwriters will also look at documentation to verify your assets, such as checking and savings accounts, stocks, bonds and proceeds from the sale of tangible items. They ensure that the borrower has the funds necessary to make the down payment, cover closing costs and make mortgage payments.

Credit Check

Underwriters take a close look at a borrower’s credit history by pulling a credit report. During a credit check, underwriters look for important factors that can indicate a borrower’s creditworthiness and ability to repay the loan. They look at a borrower’s overall credit score and search for things like late payments, bankruptcies, overuse of credit and more. Underwriters will also look at any outstanding debt and calculate a borrower’s DTI.

How Long Does Underwriting a Mortgage Take?

If all a borrower’s paperwork is finished and all the proper documentation is provided, the underwriter could finish their work within a couple days. However, if the information a borrower shared with them is incomplete in some capacity, it could take up to a few weeks to get past the underwriting stage of their mortgage approval. The borrower will need to fill any informational gaps and provide their underwriter with any additional materials they need to verify all aspects of their financial history.

To make sure this process runs as efficiently as possible, a borrower should understand what the lender expects from them, and not try to hide any less-than-perfect components of their financial records from the underwriter.

Underwriting FAQs

Here are answers to commonly asked questions about the underwriting process.

Why is it called underwriting?

The term “underwriting” has its origins in the insurance industry. It originated from the practice of having each risk-taker write their name under the total amount of risk they were willing to accept for a specified premium.

Is the loan approved after underwriting?

Once the underwriter has determined that a borrower’s loan is fit for approval, they will be cleared to close.

How long is it from underwriting to closing?

Overall, the average time to close on a mortgage – the amount of time from when the lender receives a borrower’s application to the time the loan is disbursed – is around 50 days, according to Ellie Mae.

Should I be worried about underwriting?

There’s no reason for a borrower to worry or stress during the underwriting process if they get prequalified. They should keep in contact with their lender and try not to make any major changes that could have a negative impact on this critical process. That includes taking out new debt or making a big purchase.

The Bottom Line

As you begin the work to get approved for a mortgage, it’s important to understand everything you’ll need to have prepared for the underwriting stage of the approval process. Do your research ahead of time and talk to your lender to get a sense of the information and materials needed for underwriting to be far more likely to get through the process without a hiccup.

Find A Mortgage Today and Lock In Your Rate!

Get matched with a lender that will work for your financial situation.

Mike Lerchenfeldt

Mike Lerchenfeldt is a mindful teacher and freelance writer. He's a graduate of Oakland University with a degree in education and awards for exemplary volunteer service. He teaches English/language arts in Chippewa Valley Schools. This dad of two enjoys exploring places in metro Detroit and beyond while being outside, and has traveled to Japan and New Zealand with exchange programs.