Losing a loved one can be a painful experience for everyone involved. And the experience can get even more complicated when dealing with certain implications of the loss, including the financial implications of inherited assets. If you’ve inherited an asset or plan on passing down an asset, one term to familiarize yourself with is “step-up in basis.”

Learn more about the step-up in basis, how it’s calculated and how it works when applied to real estate.

What Is A Step-Up In Basis?

A step-up in basis occurs when the value of an inherited asset readjusts to the current fair market value (FMV) for tax purposes. It’s a legal and commonly used tax strategy in estate planning that lets owners leave capital assets to an heir, and the heir avoids paying taxes on the asset’s appreciation.

A step-up in basis can apply to stocks, bonds, mutual funds and physical properties like real estate. If you’ve recently inherited any of these financial assets, we’ll cover everything you need to know to save on capital gains taxes.

See What You Qualify For

Buy A Home

Discover mortgage options that fit your unique financial needs.

Refinance

Refinance your mortgage to have more money for what matters.

Tap Into Equity

Use your home’s equity and unlock cash to achieve your goals.

Capital Gains Tax Overview

Capital gains tax is a tax you pay when you earn a profit from selling an asset for more than its original purchase price.

Let’s say you bought stock for $1. And in 2 years, the stock goes up in value, and its fair market value is now $5. If you sell the stock, you’ll pay the long-term capital gains tax rate on its $4 difference.

The length of time you hold on to an asset will ultimately determine your capital gains tax rate. If you sell an asset you owned for less than 1 year, you’ll be taxed at the short-term capital gains rate, which is your ordinary income tax level.

If you hold on to an asset for more than 1 year before you sell, you’ll pay the long-term capital gains rate, which can be 0%, 15% or 20%, depending on your income and filing status. It’s also worth noting that inherited property is always treated as a long-term capital gain opportunity.

How Much Are You Saving? 2023 Long-Term Capital Gains Tax Rates By Income | ||||

|---|---|---|---|---|

Tax Rate | Single | Married Filing Jointly | Married Filing Separately | Head Of Household |

0% | $0 – $44,625 | $0 – $89,250 | $0 – $44,625 | $0 – $59,750 |

15% | $44,625 – $492,300 | $89,250 – $553,850 | $44,625 – $276,900 | $59,750 – $523,050 |

20% | $492,300+ | $553,850+ | $276,900+ | $523,050+ |

Understanding Step-Up Cost Basis

An asset’s cost basis is its original price before it increased in value. When a financial asset appreciates and gets sold, the seller pays capital gains tax on the difference between the asset’s selling price and its stepped-up cost basis.

A stepped-up basis readjusts an inherited asset’s cost basis to its fair market value on the date of the deceased’s death. So, if an heir or beneficiary eventually sells the inherited asset, they only pay capital gains tax on the appreciated value of the asset, not the original cost basis.

How Is Step-Up In Basis Calculated?

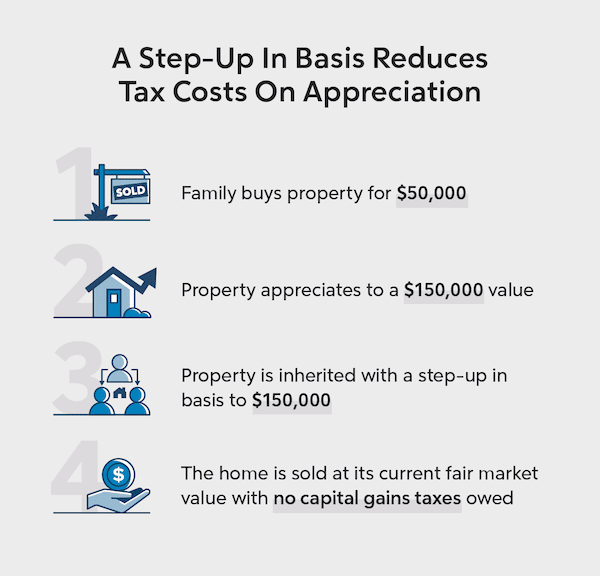

The step-up in basis is the difference between an asset’s current value and its cost basis at the time it was purchased by the original owner. For better understanding, let’s take a look at an example of how step-up in basis is calculated.

Step-Up In Basis Example

Suppose a grandparent left you a piece of land they originally purchased for $50,000. And when you inherit the land, it’s worth $150,000, so the step-up in basis is $100,000.

The step-up in basis provision is a money saver that reduces tax liability. When you sell the land, it will reduce the cost basis for your capital gains tax. You’ll pay capital gains taxes on the difference between the land’s $150,000 fair market value and its sales price.

With the step-up in basis, if you sell the land for $200,000, you’ll owe capital gains tax on $50,000 ($200,000 – $150,000). Without the step-up in basis provision, if you sell the land for $200,000, you will owe taxes on the $150,000 capital gains ($200,000 – $50,000).

A step-up in basis can drastically lower your tax bill when you sell.

Double Step-Up In Basis For Community Property

Step-up in basis applies to community property differently, which affects widowed partners assuming their spouse’s stake in a shared property.

Most states apply a 50% step-up in basis to the deceased partner’s share. So, if a $100,000 property increases in value to $200,000, a step-up applies to 50% of the appreciation, resetting its cost basis to $150,000.

However, nine states recognize community property shared by a couple and allow residents to apply a double step-up in basis rule that raises cost basis to an asset’s current FMV. This includes a step-up for the deceased and surviving spouse’s stake in an asset.

In the example above, if the property were community property in Arizona, the step-up would meet the $200,000 current market value.

These community property states allow a double step-up in basis:

- Arizona

- California

- Idaho

- Louisiana

- New Mexico

- Nevada

- Texas

- Washington

- Wisconsin

Find A Mortgage Today and Lock In Your Rate!

Get matched with a lender that will work for your financial situation.

Step-Up In Basis FAQs

Taxes are complicated enough without the extra layer of dealing with a loss and managing inherited assets. Use the answers to these common questions to help steer you in the right direction for your step-up in basis.

What happens if you don’t sell the appreciated asset?

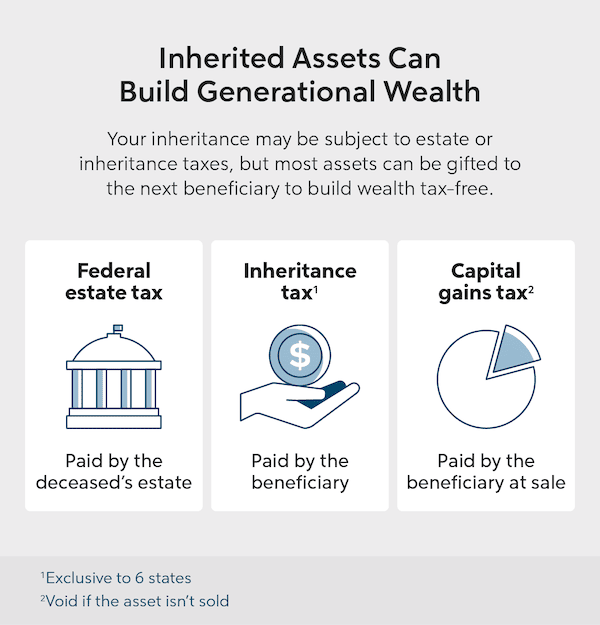

A beneficiary or heir automatically receives the stepped-up cash basis even if they choose not to sell an inherited property. They won’t pay capital gains taxes as long as they own the asset.

The asset can be passed down over generations, receiving a step-up in basis with each inheritance. This is a great way to build generational wealth without leaving your descendants a large tax bill on the assets they inherit.

Are primary residences exempt from capital gains taxes?

Primary residences are exempt from capital gains tax up to a specific amount based on your tax filing status. Individual taxpayers are exempt up to $250,000, and joint taxpayers are exempt up to $500,000. Any capital gains above these caps are subject to taxation.

For example, if you buy a home as a single adult for $150,000 and it appreciates to $400,000 in 15 years, the capital gains are $250,000. If you sell the house for $400,000, you may be exempt from paying the capital gains tax.

Is step-up in basis a tax loophole?

The tax provision isn’t technically a loophole, though it’s been criticized for disproportionately benefiting wealthy families and exacerbating the wealth gap. Supporters contest that the step-up in basis prevents double taxation and encourages Americans to save money and appreciate assets.

What assets don’t get a step-up in basis at death?

Untaxed income, retirement savings and interest-bearing accounts aren’t eligible for a step-up in basis, including:

- 401(k) accounts

- IRAs

- Pensions

- Tax-deferred annuities

- Certificates of deposit

- Money market accounts

Gifts transferred prior to death that are not inherited are also ineligible for a step-up in basis.

How does a step-up in basis work with trusts?

Revocable and living trusts allow the grantor (the trust owner) to control the trust until the trust’s terms are fulfilled. Then, the property goes to the beneficiaries after the grantor’s death. Step-up in basis typically operates the same way for a trust – an heir inherits an asset at its fair market value on the date of a grantor’s death. However, a step-up in basis may work differently with irrevocable trusts. The method will depend on the structure and type of trust. For example, grantor trusts have different guidelines than non-grantor trusts.

Before establishing a trust, speak with a financial advisor and estate planning attorney to guide you through the ins and outs of the process. Partnering with professionals can help ensure your trust fulfills your wishes and abides by federal and state laws.

The Bottom Line

Losing a loved one can be a heartbreaking experience and dealing with an inheritance amid everything else can feel overwhelming. Familiarizing yourself with the tax rules around the step-up in basis now can help you make informed decisions, get the most out of your inheritance and minimize your tax bill when you sell an asset.

You may also want to consult with a financial advisor to help you navigate the details of your inheritance. Check out our Learning Center to learn more about living trusts, as well as inheritance and estate planning.

Find A Mortgage Today and Lock In Your Rate!

Get matched with a lender that will work for your financial situation.

Victoria Araj

Victoria Araj is a Staff Writer for Rocket Companies who has held roles in mortgage banking, public relations and more in her 15-plus years of experience. She has a bachelor’s degree in journalism with an emphasis in political science from Michigan State University, and a master’s degree in public administration from the University of Michigan.