Knowing the type of interest you pay on a loan can prevent you from making detrimental financial decisions.

Many loans charge simple interest, the most attractive form of interest on any loan. Here’s everything you must know about the simple interest formula, how it works, and when it applies.

What Is Simple Interest?

Simple interest is the cost of borrowing money without compounding accumulated interest. The amount of interest you pay with simple interest is based only on the outstanding principal, otherwise known as your unpaid loan amount.

Most mortgage loans are common simple interest loans. Mortgage rates help cover the lending cost to borrowers, but the interest isn’t compounded. You pay interest only on the remaining principal balance each month instead of paying increasing interest charges.

On the other hand, credit cards have compounded interest, often compounded daily. This means you are charged interest on your interest charges. This is often why getting out of credit card debt is so hard.

For example, if you charge $100 at 20% interest compounded daily, your balance is higher than $100 every day, and it continues climbing until you pay the balance in full. It’s always in your best interest to pay credit card balances fast or make more than the minimum payment.

See What You Qualify For

Buy A Home

Discover mortgage options that fit your unique financial needs.

Refinance

Refinance your mortgage to have more money for what matters.

Tap Into Equity

Use your home’s equity and unlock cash to achieve your goals.

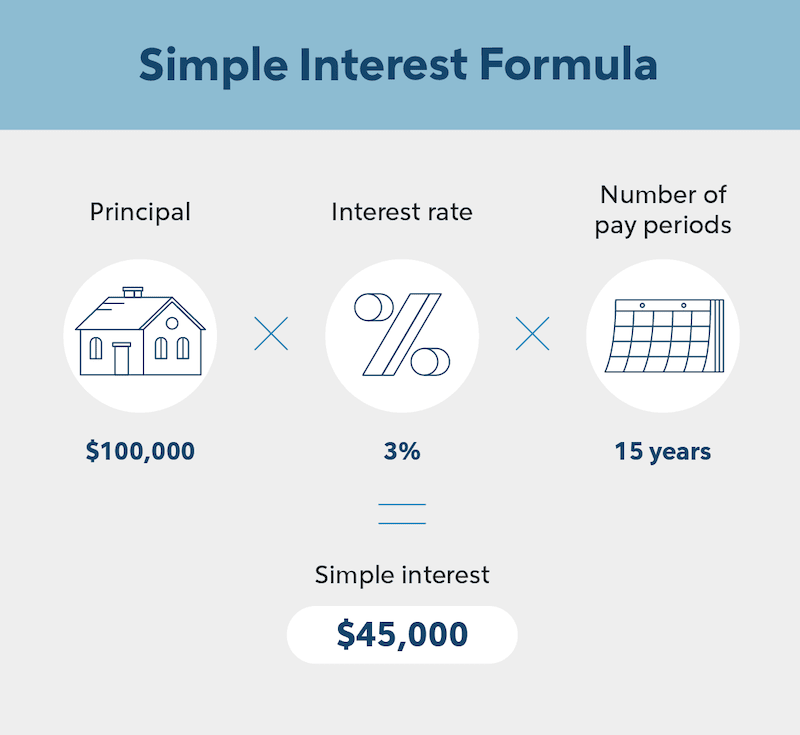

How To Calculate Simple Interest

It’s easy to figure out how to calculate simple interest because you don’t have to factor in any compounding.

The formula is as follows:

Principal × Interest Rate × Number of Years = Simple Interest

1. Determine Your Variables

Learning how to calculate simple interest requires you to understand the variables, including:

- Principal: The amount you borrow. For example, if you borrowed $10,000 with a personal loan, your principal balance is $10,000

- Interest: The interest rate charged on the loan. This is the lender’s charge for lending you the money. It’s expressed as a percentage of the loan amount

- Number of years: The time you have to repay the loan. Most mortgage loans, for example, have terms of 10 to 30 years

For example, say you borrowed $10,000 principal at 6% on a 1-year personal loan. You’d pay interest on the $10,000 at 6% for the year the loan is outstanding.

2. Plug In The Numbers

Looking at our above example, here’s a simple interest example in action:

$10,000 x .06 x 1 = $600

This means your total interest charges would be $600, and the loan would cost you a total of $10,600 to pay back in full one year after you borrowed the money.

3. Use The Simple Interest Formula

Knowing how much interest you’ll pay can help you determine the cost to borrow money and select the right loan.

Loans with higher interest rates result in a larger monthly mortgage payment, but other factors play a role, too, including the principal amount and the loan term.

It’s a good idea to shop around for different mortgage loans, comparing different interest rates and terms to see how it affects your monthly payment and the loan’s overall cost. You may find loans with different terms make more sense only because you pay less interest on the loans.

Getting A Personal Loan Has Never Been Easier.

The process makes borrowing simple.

How Does Simple Interest Work In Real Estate?

Simple interest in real estate is similar to simple interest in any other loan because you don’t pay interest on the accumulated interest.

The interest charges are recalculated each month based on the current principal balance, applying the difference in interest due each month from your mortgage payment to the loan’s principal.

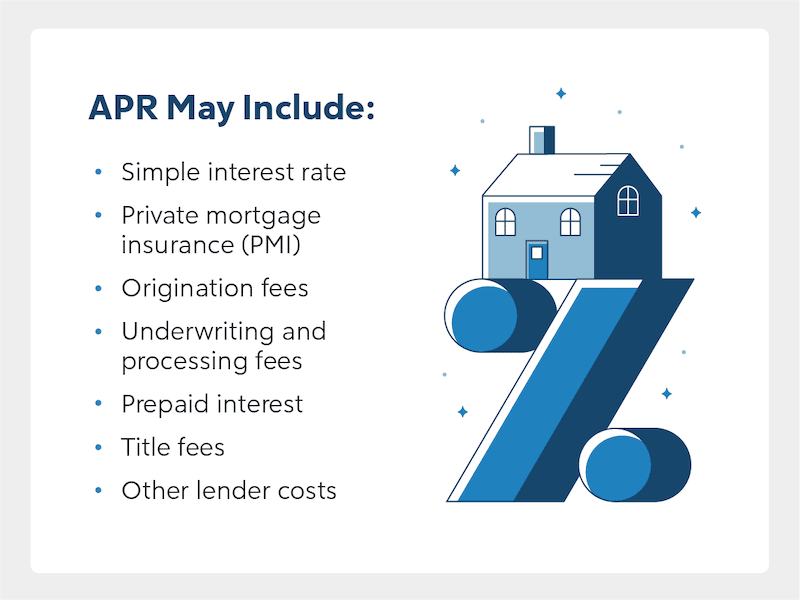

What Is Simple Interest Vs. Annual Percentage Rate (APR)?

Simple interest in real estate is a little more complicated than other loans. While you don’t pay interest on accumulated interest with mortgage loans, other fees affect your annual percentage rate (APR), including:

- Origination fees

- Underwriting fees

- Prepaid interest

- Title fees

- PMI

You can lower your loan’s APR by securing a lower interest rate, sometimes by paying discount points if you can’t secure a lower rate without it. A higher APR signifies that you’ll pay the lender more costs for the loan.

How To Calculate Simple Interest With APR

Calculating simple interest with APR is a much more complicated formula. However, lenders are required by law to disclose the APR, so you don’t have to worry about calculating it.

To see how it works, here’s the formula:

(APR = ((Interest Charges + Fees) ∕ Principal ∕ # Of Days In Loan Term × 365) × 100)

When calculating APR, you’ll include other charges, not just the amount borrowed. It considers the costs and how it affects the yearly cost of borrowing the money, considering everything the lender charges.

Simple Interest And Amortization

Simple interest affects your mortgage amortization or how your mortgage payment is allocated. At the start of your mortgage, most of your payment covers the interest charges.

Each month, the interest charges decrease as you pay the principal balance down (even slightly).

For example, with a $300,000 30-year fixed mortgage at 6%, the first payment includes $1,500 in interest. By year two, though, the interest charges on the first payment of the year drop to $1,481.58; by the first payment of year five, they are $1,395.82, and by year 20, they are $810.05.

Don’t worry; you don’t have to figure it out yourself. You can use an amortization calculator to see the differences.

Simple Interest And How To Reduce Mortgage Costs

Simple interest works differently depending on your mortgage type, whether it’s a fixed-rate or adjustable-rate mortgage.

Simple Interest And Fixed-Rate Mortgages

If you have a fixed-rate mortgage, the rate doesn’t change for the life of the loan. To lower the total cost of borrowing money on a fixed-rate loan, consider bi-weekly payments or making extra payments toward the loan’s principal whenever possible.

If you have a stable income that allows you to afford a shorter term with a higher payment, consider a 15-year fixed-rate mortgage. You’ll pay less in interest because you borrow the money for 15 fewer years.

Using the same numbers as above, borrowing $300,000 at 6%, but this time for 15 years, you’d pay $156,000 in interest instead of $348,000. But only choose this option if you can comfortably afford the larger payment because 15-year payments require more principal since there’s less time to pay it in full.

Simple Interest And Adjustable-Rate Mortgages (ARMs)

Adjustable-rate mortgages (ARMs) have lower interest rates initially, but then they adjust after the introductory period. There’s no way to predict if the rates will increase or decrease, which means paying more or less interest monthly.

If you choose an ARM, it’s important to know when rates adjust so you can decide on how to proceed. You may consider refinancing your mortgage or selling the property to save money.

Simple Interest FAQs

What Kinds Of Loans Use Simple Interest?

Most short-term loans use simple interest, as do mortgages. Common short-term loans include personal and auto loans. This means you don’t pay interest on interest, like you do with credit cards.

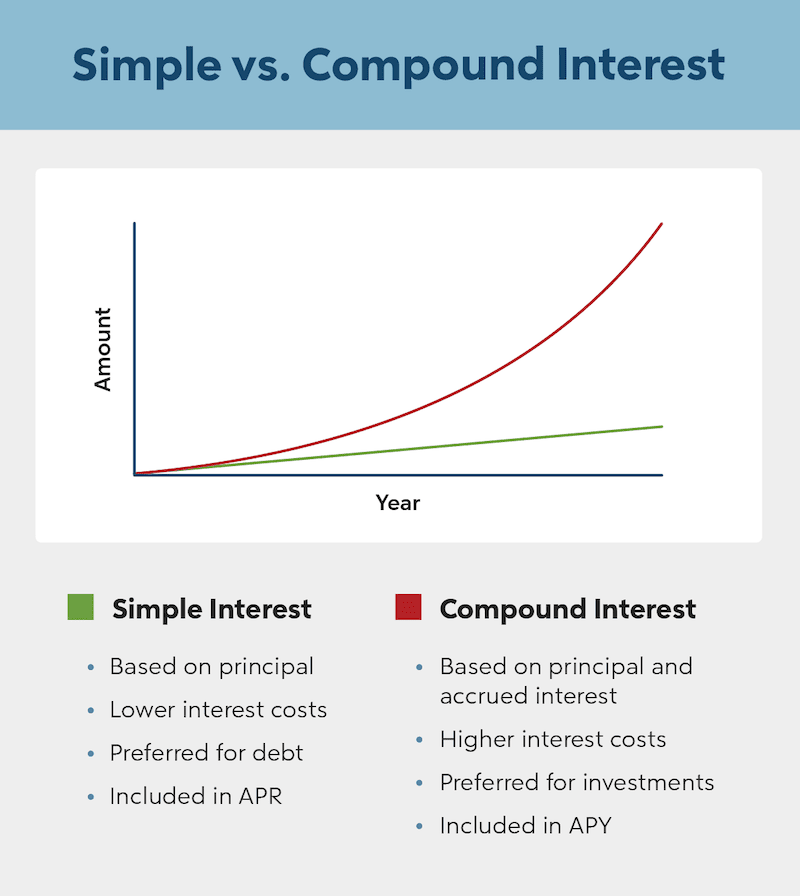

What’s The Difference Between Simple Interest And Compound Interest?

Simple interest incurs interest only on the money borrowed, known as the principal. Compound interest is interest calculated on the principal plus accumulated interest.

So, if you have a loan with daily compounded interest, the interest charges increase daily based on the previous day’s balance, including interest.

Are Mortgages Compound Or Simple Interest Loans?

Fortunately, mortgage loans are simple interest loans. This means you only pay interest on the amount borrowed. You don’t pay interest on the interest, which would make mortgage loans unaffordable for most.

The Bottom Line

Simple interest is the most attractive form of interest and makes it easy to compare loan options to make the right choice.

Only paying interest on the amount borrowed is much easier to understand than paying interest on interest. This is why mortgage loans are often considered ‘good debt,’ but credit card debt is considered bad.

Find A Mortgage Today and Lock In Your Rate!

Get matched with a lender that will work for your financial situation.

Victoria Araj

Victoria Araj is a Staff Writer for Rocket Companies who has held roles in mortgage banking, public relations and more in her 15-plus years of experience. She has a bachelor’s degree in journalism with an emphasis in political science from Michigan State University, and a master’s degree in public administration from the University of Michigan.