You pay the same bills, have the same number of loans and have always been responsible with your credit cards, yet your credit score changes from month to month. It can seem like your credit score fluctuates up or down like the seasons even if you seemingly haven’t done anything to influence it.

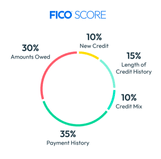

However, your credit score won’t drop without reason. Scores fluctuate based on changes to five primary factors, and each impacts your score to a different extent. These factors include your credit utilization, payment history, length of credit history, new credit and credit mix.

According to the FICO® scoring model, the two biggest factors affecting your score are payment history, which accounts for 35% of your score, and credit utilization, which accounts for 30%. Fortunately, these are also the two factors that you have the most consistent control over as a consumer.

This article will discuss factors that can impact your credit and explain why your credit score dropped for seemingly no reason.

Key Takeaways:

- Credit scores never drop without reason. Various factors can impact your creditworthiness, including payment history, credit utilization, length of credit history, new credit and credit mix.

- Your payment history and credit utilization have the biggest impact on your credit score. Paying bills on time and keeping credit card balances low can help you improve your score.

- Paying off a loan can also lower your credit score. When you pay off a loan, the positive impact of regular payments no longer helps boost your score. Additionally, paying off a loan could affect your credit mix or utilization.

- A falling credit score could indicate an identity theft concern, which is why it’s so important to review your credit report on a regular basis.

What’s Your Goal?

Buy A Home

Discover mortgage options that fit your unique financial needs.

Refinance

Refinance your mortgage to have more money for what matters.

Tap Into Equity

Use your home’s equity and unlock cash to achieve your goals.

Why Your Credit Score Matters

Your credit score is used by lenders to determine how likely you are to repay a loan you borrow. It’s especially important when trying to buy a house, and it plays a huge part in deciding your rates and terms for the loan.

Your credit score is calculated based on your payment history, the amount of money you owe, the length of your credit history, the type of credit you have and new credit that has been added, so a change in your score means one of those factors has changed.

There are several credit scoring models, but FICO® scores are used by the majority of top lenders. FICO® scores break down into the following ranges:

- Less than 580: Poor

- 580 to 669: Fair

- 670 to 739: Good

- 740 to 799: Very Good

- 800 and higher: Exceptional

These ranges give lenders insights about consumers’ creditworthiness and the risk they may pose. For example, a loan applicant with excellent credit shows lenders they have a track record of responsible borrowing. Meanwhile, someone with a poor credit score has likely missed payments or defaulted on a loan, which signals more risk to lenders.

Not only do lenders use credit scores to approve or deny a loan application, but they also use them to determine borrowers’ interest rates. Generally, the better your credit, the lower your interest rate and the less you’ll pay for a loan. On the flip side, lenders usually charge higher interest rates to riskier borrowers, or those with lower credit scores. This helps lenders insure potential losses in case the borrower defaults on the loan.

Ready To Refinance?

Get matched with a lender that can help you reach your financial goals.

Falling FICO® Scores: Reasons For Lower Credit Scores

Sometimes your score does change based on factors outside of your control, but most times your behavior influences your score in ways that may not be obvious.

Let’s take a look at the factors that influence your score and a few reasons why it might change even when you don’t think you’ve changed your behavior.

Your Credit Utilization Has Changed

Your credit utilization is the percentage of available credit you’re using. It influences your credit score, so a change in either your balance or your revolving credit limit can cause your score to adjust.

Lenders like to see that you aren’t using all of your available credit. If you’re consistently maxing out your accounts, lenders may think you’re financially spread thin and therefore more likely to default on a loan. Typically, having less than a 30% credit utilization (i.e., spending $300 or less if your credit limit is $1,000) can keep your credit in top shape.

Consider rolling debt, too, which is credit card debt you carry from month to month. Paying off your credit card balance each month helps lower your utilization ratio, while carrying a balance – and then spending more the following month – increases your credit utilization. Keep in mind that if you’re making only minimum payments, your balance and credit utilization can snowball.

Check to see if your credit card company has increased or decreased your total limit. If your spending habits remained the same, an increase in your credit limit would decrease your credit utilization ratio, which can positively impact your score. A decrease in your credit limit would increase your utilization ratio; thus, your score could go down.

You Missed Payment Due Dates

Think back on your payment history. Have you missed a credit card payment in the last few months? Were there any bills that you may have missed in previous months? If so, this could drastically reduce your credit score, as payment history makes up 35% of your FICO® score.

Missed payments are typically not reported to the credit bureaus until they’re at least 30 days late, so your score won’t be impacted until after that time. Your score will be hurt by a payment that’s more than 30 days late, but a delinquency, referring to a payment that is over 30 days late, can devastate your score.

Thankfully, missed payments and derogatory marks won’t stay on your credit report forever. The greater the age of those marks on your credit score, the less impact they have, so you may see your score recover over time while your behavior remains consistent.

Late payments over 30 days will remain on your credit report for 7 years, while derogatory marks like bankruptcy can remain on your report for up to 10 years. Over time your score will recover, and once these marks fall off your credit report, you may see an instant boost in score.

You Paid Off A Loan Or Debt

Paying off a loan or debt sounds like a good thing, and it can be. But it can also cause a temporary drop in your credit score. This is because these lenders are no longer reporting your on-time payments to credit bureaus.

Additionally, paying off an account shortens your credit history, and roughly 10% of your score is based on how old your accounts are. If you’ve paid off a loan in the past few months, you may just now be seeing your score go down.

Your score could be negatively impacted by a closed credit card, too. Not only will closing a card shorten your credit history, but it will also lower your credit limit and impact your credit utilization ratio.

Often you’ll be the one authorizing a credit card to close, but card companies can close them without your knowledge. The Equal Credit Opportunity Act (ECOA) allows creditors to close a card due to inactivity, delinquency or default with no notice. If a creditor closes an account for any other reason, they don’t have to notify you before doing so.This means it’s possible you have a closed credit card that you don’t even know about.

There Has Been A Recent Inquiry On Your Report

If you’ve recently applied for a credit card or loan, the lender has probably pulled your credit report. This is considered a hard inquiry, occurring when a lender checks your credit to determine if they want to lend you money. A hard inquiry will temporarily lower your score, especially if you apply for multiple new accounts within a short period of time.

Your Credit Mix Is Unbalanced

Your credit mix makes up 10% of your FICO® score and refers to the variety of accounts you have, such as a personal loan, a mortgage and credit accounts. This factor only makes up a small portion of your overall credit profile, and you don’t need every type of account to have good credit. However, having multiple types of credit accounts, especially longstanding accounts like a mortgage, can show lenders you’re capable of managing different types of debt.

View Your Refinancing Options

Find a refinance lender that will work with your unique financial situation.

When To Worry About Falling A Credit Score

Changes in your credit score are completely normal, so there’s no need to worry about small fluctuations. That being said, it’s good to check your credit report at least once per month so you can monitor these changes when they occur.

You may want to take note of large changes in your score as they could be an indication that something bigger is happening – for example, if you have unauthorized accounts opened in your name or you’ve been a victim of identity theft.

The Importance Of Regularly Checking Your Credit Report

The next time your credit score changes, ask yourself the following questions:

- Have I spent more or less money this month compared to previous months? If so, your credit utilization ratio may have changed.

- Did I miss a payment in the past few months? If so, you could have a delinquent payment that’s hurting your score.

- Did a missed payment or derogatory mark from several years ago fall off my credit report? If so, your credit score may be going up.

- Have I applied for credit? An inquiry may have been placed on your report, which can negatively impact it.

- Have I recently paid off a loan or closed a credit card? If so, your credit history may have been impacted.

After looking closer, you may find something has changed that could influence your credit score that you weren’t initially aware of. The best way to monitor changes in your score is to check your credit report monthly so that you’re up to date on all the changes that impact your score.

Checking your credit report not only keeps you informed, but it also gives you the opportunity to find errors and potential signs of identity theft. You can access free weekly copies of your credit report at AnnualCreditReport.com. If you do find an error, report it in writing to the credit reporting company. Include any documentation that supports your dispute. After that, send a dispute letter to the creditor that reported the error. Creditors typically have 30 days to investigate and respond to your dispute.

Finally, if you find evidence of identity theft, report it online at IdentityTheft.gov.

FAQ For Why Your Credit Score Is Going Down

The VantageScore® model is based on a range of 300 – 850, where anything below 661 is considered “bad.”

The FICO® model uses a range of 280 – 850, with a “bad” score being any under 670.

For the most part, lenders will look at your FICO® score when considering your approval for a loan.

The Bottom Line

It can be disheartening to see your credit score drop for seemingly no reason. Change can happen without your realizing it, though, so it’s important to keep an eye on your score. This is especially important if you’re planning to take out a loan or a mortgage in the future.

If your score falls, remember what you can do to improve it. Pay your bills on time, try to keep your credit utilization low and check your credit report regularly for errors. Finally, remember that it’s normal for your credit score to fluctuate. Try not to worry every time your score takes a dip – instead, focus on the bigger picture and aim for general improvement over the long run.

Ben Shapiro

Ben Shapiro is an award-winning financial analyst with nearly a decade of experience working in corporate finance in big banks, small-to-medium-size businesses, and mortgage finance. His expertise includes strategic application of macroeconomic analysis, financial data analysis, financial forecasting and strategic scenario planning. For the past four years, he has focused on the mortgage industry, applying economics to forecasting and strategic decision-making at Quicken Loans. Ben earned a bachelor’s degree in business with a minor in economics from California State University, Northridge, graduating cum laude and with honors. He also served as an officer in an allied military for five years, responsible for the welfare of 300 soldiers and eight direct reports before age 25.