How Much To Offer On A House + Reasonable Offer Chart

You’ve just spent weeks scrolling through listings and setting up walkthroughs when you finally find a home you want to purchase. The next step is to make an offer, but how do you know how much to offer on a house?

Whether this is your forever home or your first home, we’ll help guide you step-by-step on how much you should offer on a house, including a reasonable offer chart.

Table Of Contents

6 Considerations Before Making An Offer On A Home

When To Offer Over And Under Asking Price

See What You Qualify For

You can get a real, customizable mortgage solution based on your unique financial situation.

6 Considerations Before Making An Offer On A Home

Do you want to make sure your offer is accurate and reasonable, but aren’t sure where to start?

It’s best to discuss with your real estate agent how to approach the individual listing. However, you should also run through the questions below to help you gauge the ideal offer price.

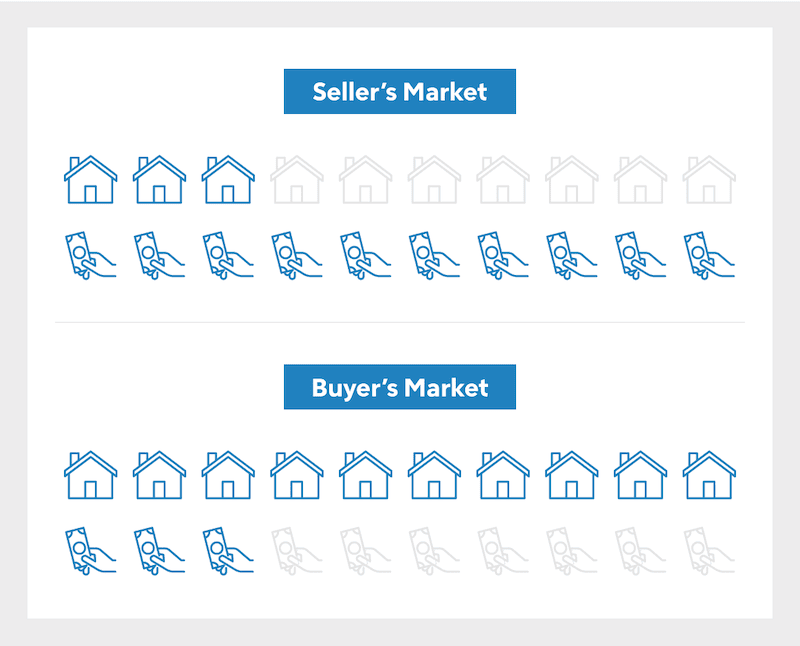

1. Is It A Seller’s Or Buyer’s Market?

When making an offer, the first thing to consider is the local market conditions. Market conditions depend on the number of homes for sale and the number of buyers.

If there are more buyers than there are homes available to purchase, you may need to make a higher offer to beat out the competition. If there is an abundance of homes on the market and not as many buyers, your offer could be lower. Let’s look at the differences between the types of markets.

Seller’s Market

A seller’s market is when there’s a low inventory of homes with high listing prices. This market usually has more buyers looking for homes than the number of homes available for sale. This causes more frequent bidding wars, which drives up home sale prices. In a seller’s market, it’s more likely you’ll pay at or above the listing price.

Buyer’s Market

A buyer’s market is when there’s a high inventory of homes with low listing prices. This market usually has more homes for sale than buyers looking to purchase. In this case, it’s more common to make offers below the listing price, and even contingent offers are accepted.

Balanced Market

A balanced market is when there is an equal number of buyers and houses up for sale. Listing prices aren’t too low or inflated. In a balanced market, you’ll rely more heavily on your real estate agent’s expertise and experience with negotiating offers.

2. How Long Has The Listing Been Active?

When preparing to make an offer, it’s important to pay attention to the property’s history. This will gauge how much you should offer on the house. For example, has the property been on the market for several months and experienced multiple price reductions? If so, there may be more motivation for the seller to sell the property. The buyer may be willing to negotiate the asking price with a lower offer.

However, what if the property has only been on the market for a couple of days? Then it’s best to stick with an offer that at least matches the asking price. This type of information can usually be found on the listing site, or you can ask your real estate agent to pull the information for you.

3. What Is The Condition Of The Property?

The condition of the property can heavily influence your offer. You’ll find that move-in ready homes are listed at a higher price than properties needing extensive cosmetic repairs.

Consider the state of the home before determining your final offer. Ask yourself, “Am I looking for a home to remodel and make my own?” or “Am I looking for a move-in ready home?” You can request a home inspection contingency to negotiate repairs and the sale price if a good amount of work needs to be done to the home.

4. How Much Can You Afford?

Figuring out how large of an offer you can make will be based on your established budget. You should have a ballpark number in mind before searching and seeing homes.

Your budget should consider your income, credit score, where you live and how much debt you have. Factor in other costs like home inspections, mortgage payments, average utility costs, etc. Use a home affordability calculator to calculate the maximum offer you can make.

5. How Does The Listing Price Compare To The Local Market?

Once you know your offer budget, you should look at how the listing price of the property compares to similar properties in the area. Your real estate agent should be able to put together a comparative market analysis that shows you the listing and final sale prices of local homes in the last several months.

This will help you gauge if the current listing price is fair and reasonable. For example, let’s say you see similar homes being sold for $10,000 to $15,000 less than the asking price of your potential home. If you’re in a buyer’s market, it’s probably safe to make an offer $10,000 below the asking price.

6. How Much Do You Want This Property?

If the asking price of the property matches the local market and its history, then you should lastly assess whether or not it fits all your needs in a new home. Ask yourself the following questions to determine if it’s the right home for you:

- Will I need to make any alterations to the home? If so, how much will they cost?

- Is the asking price within my budget? If it is, is it toward the top, bottom or right in the middle?

- Will this property meet almost all of my needs?

Once you’ve answered these questions, you should know if you want to make an offer on your desired property. The next step is to decide how much you’re willing to offer.

Take the first step toward buying a house.

Get started today to see what you qualify for.

See What You Qualify For

Home Purchase

Home Refinance

Tap Into Equity

When To Offer Over And Under Asking Price

There are times when offering over the asking price is necessary, and there are situations when offering under the asking price will work. It’ll depend on the type of market you’re in and the circumstances.

When To Offer Over The Asking Price

There are scenarios when you should offer over the asking price. If it’s a seller’s market and there’s lots of competition for a home, a higher offer could give you the upper hand and seal the deal.

Exactly how much over the asking price you should offer will depend on the listing and the local market. Your real estate agent should know what other similar properties are being sold for. Take this into consideration when determining how high you’re willing to go within your budget.

Make sure you’re comfortable with your max offer. You don’t want to make an offer on a home you won’t be able to afford down the road. Rely on your real estate agent to find out what other bidders are offering.

Most appropriate situation: When there’s a lot of competition for a home in a seller’s market

When To Offer Under The Asking Price

There are circumstances when it’s possible for an offer below the asking price to be accepted. This usually occurs in a buyer’s market, especially when a property has been on the market for a long time.

But how much should you offer under the asking price? Seek advice from your real estate agent, but also look to the guidelines below for assistance.

- Less than 10% below: If the property is in fair condition but requires some cosmetic repairs, this is a suitable price range. If the home is move-in ready and doesn’t require any cosmetic updating, shoot for an offer closer to the asking price. This will decrease the chances of requiring a counteroffer.

- 10% – 20% below: If the house is outdated and requires larger renovations, this price range may be suitable. For example, if the property requires new flooring and upgraded appliances, making an offer in this range will help cover those costs.

- 20% below: This is considered a lowball offer, and is best if the property requires extensive restoration to make it livable. Repairs include plumbing or electrical issues, foundation repairs or extreme water damage.

Most appropriate situation: When there’s no competition for a property in a buyer’s market

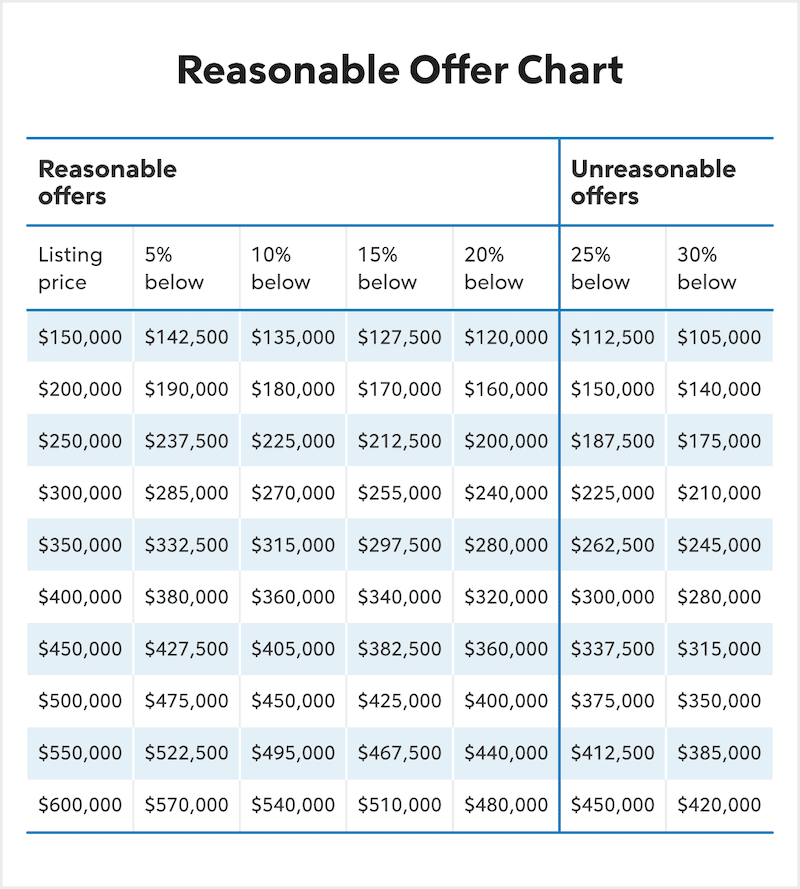

Reasonable Offer Chart

Ready to crunch the numbers for the best offer? Use the reasonable offer chart above to determine how much you should offer, depending on the considerations we just walked through.

Home Affordability Calculator

Calculate the home price you can afford using your income and the amount of debt you have.

FAQ

Have more home buying questions? Keep reading for more housing market insights and strategies.

How Much Do I Offer On A House With Multiple Offers?

If you’re in a seller’s market, it’s common to compete against multiple offers in the hopes of getting your offer accepted. Before jumping into a bidding war, however, be sure this property is worth paying a bit over the asking price. If you think you can fall in love with another property, it may be best to step away and keep looking.

When competing against other bidders, don’t forget to respect your budget. You want to avoid overbidding on a home you won’t be able to afford down the road. How much you offer on a house with multiple offers is dependent on how the other offers look and recommendations from your real estate agent. If you want to seal the deal, a cash offer always looks best to the seller.

Is 10% A Lowball Offer?

Offering 10% under the asking price isn’t necessarily a lowball offer. Typically, a lowball offer is considered to be at least 20% below the asking price. If you’re offering 10% below, the property should be in a good condition but may just need some cosmetic work done. The goal of offering 10% below the asking price is to use those extra funds to cover the repairs.

Can You Offer 20% Less On A House?

You can offer 20% less on a house in certain conditions. If you’re in a buyer’s market and the property isn’t up to code or needs serious renovations to be habitable, this offer is more reasonable.

Ready to buy a home? Consult with a real estate professional to get started finding your dream home. Don’t forget to also brush up on your real estate knowledge before diving into the market.

Take the first step toward buying a house.

Get approved to see what you qualify for.